Bank Of America Credit Card Customer Care Number access is vital for resolving issues and managing your account effectively. CARS.EDU.VN provides a detailed guide to help you navigate Bank of America’s customer service options and address your needs efficiently. Get immediate support and valuable insights for a seamless banking journey with our comprehensive credit card assistance.

1. Understanding Bank of America Credit Card Customer Care

Effective customer service is paramount when managing your credit card, especially with a large institution like Bank of America. Knowing how to navigate their customer care system can save you time and reduce stress. Bank of America offers multiple avenues for support, including phone, online resources, and mail. This section will guide you through each option, ensuring you can find the help you need quickly and efficiently.

1.1. Why Accessing Customer Care is Essential

Accessing customer care is essential for several reasons, including:

- Resolving Disputes: Addressing incorrect charges or fraudulent activity.

- Account Management: Updating personal information, requesting credit limit increases, or closing accounts.

- Technical Support: Getting help with online banking or mobile app issues.

- General Inquiries: Clarifying terms, understanding fees, or inquiring about rewards programs.

1.2. Common Reasons to Contact Customer Service

Here are some common scenarios where contacting Bank of America’s customer service is beneficial:

- Lost or Stolen Card: Reporting a lost or stolen card immediately to prevent unauthorized charges.

- Fraudulent Transactions: Disputing unfamiliar transactions on your statement.

- Billing Errors: Correcting inaccuracies in your billing statement.

- Reward Redemption: Assistance with redeeming your credit card rewards.

- Payment Issues: Addressing problems with payments or setting up payment plans.

- Credit Limit Adjustments: Requesting an increase or decrease in your credit limit.

- Account Closure: Closing your credit card account securely.

- Travel Notifications: Informing Bank of America of your travel plans to avoid blocked transactions.

2. Reaching Bank of America Customer Service by Phone

One of the quickest ways to get assistance is by calling Bank of America’s customer service. Whether you have a lost card, billing inquiry, or need help with your account, knowing the right number to call is crucial. This section breaks down the key phone numbers and provides tips for a smooth call experience.

2.1. Key Phone Numbers for Credit Card Assistance

Here are the primary phone numbers you might need:

- Credit Card Customer Service (including lost or stolen card): 800.732.9194 (24/7)

- International Customer Service: 1.302.738.5719 (24/7, international cell phone roaming charges may apply)

- Credit Card Activation: 800.276.9939 (24/7)

- Credit Card Billing Inquiries: 866.266.0212

2.2. Preparing for Your Call

Before you dial, gather the necessary information to expedite the process:

- Credit Card Number: Have your credit card number handy.

- Personal Information: Be ready to verify your identity with your Social Security number, date of birth, and address.

- Specific Details: Write down the details of your issue or question. For example, if you’re disputing a charge, note the date, amount, and merchant.

2.3. Navigating the Automated System

Many banks use automated systems to direct your call. Here are some tips for navigating it effectively:

- Listen Carefully: Pay attention to the menu options.

- Use Keywords: Speak clearly and use keywords related to your issue (e.g., “lost card,” “billing dispute”).

- Request a Representative: If the automated system can’t help, ask to speak to a live representative.

2.4. What to Expect When Speaking to a Representative

When you connect with a customer service representative, be prepared to:

- Verify Your Identity: They will ask for information to confirm you are the cardholder.

- Explain Your Issue Clearly: Provide a concise and accurate description of your problem.

- Take Notes: Write down the representative’s name, employee ID (if provided), and any reference numbers for your case.

- Follow Instructions: Listen carefully and follow any instructions given.

- Be Patient and Polite: Maintaining a calm and respectful tone can help ensure a productive conversation.

2.5. Utilizing Relay Services and Language Interpretation

Bank of America accommodates customers with disabilities through relay services. You can dial 711 to access these services. Additionally, language interpretation services are available at no cost. You can request an interpreter when speaking with an agent on the phone or at a financial center.

3. Online and Mobile Customer Service Options

In today’s digital age, many customers prefer handling their banking needs online. Bank of America offers robust online and mobile banking platforms for managing your credit card. This section explores these digital options and how to leverage them for customer service.

3.1. Bank of America Online Banking

Bank of America’s Online Banking platform allows you to manage your credit card account from your computer. Here’s how to access it:

- Log In: Visit the Bank of America website and log in with your username and password.

- Account Summary: View your current account status, including balance, available credit, and payment due date.

- Transaction History: Request up to 12 months of detailed transaction information.

- Download Transactions: Download transactions for use with financial management software.

- Make Payments: Pay your credit card bill online.

- Contact Customer Service: Access customer service options, including secure messaging.

3.1.1. Checking Your Balance Online

The easiest way to check your credit card balance is to log in to Online Banking. In addition to checking your balance, Online Banking also allows you to:

- Get a summary of your current account status, including balance, available credit and information on when your next payment is due

- Request up to 12 months of detailed transaction information

- Download transactions for use with financial management software

- Make a payment online

- Contact customer service

3.1.2. Redeeming Rewards Online

To check your rewards points balance and cash in or redeem your rewards points online, log in to Online Banking and select your credit card then select the Rewards tab. Not an Online Banking customer? Enroll in Online Banking today

3.1.3. Accessing Fee Information Online

To learn more about fees associated with your credit card account, log in to Online Banking and select the link to your card account, then select the Information & Services tab where you’ll find a section entitled Fee information. You can also review FAQs about fees or the credit card agreement you received when you opened your account.

3.1.4. Disputing Transactions Online

Online Banking customers can submit most credit card disputes directly from the transaction detail found in the Activity tab on your credit card account page, or from the Dispute a transaction link on the Information & Services tab. To access the credit card dispute process, log in to Online Banking.

3.2. Bank of America Mobile App

The Bank of America Mobile Banking app offers similar features to the online platform, but with the added convenience of managing your account on the go.

- Download and Install: Download the app from the App Store (iOS) or Google Play Store (Android).

- Log In: Use the same username and password as your Online Banking account.

- Key Features: Check balances, pay bills, transfer funds, and access customer support.

3.2.1. Redeeming Rewards on Your Mobile Device

Log in to the Mobile Banking app and tap the View My Rewards link to view/redeem available rewards balance. You can also tap the Erica icon and say, “I want to redeem credit card rewards” and follow the instructions (if you prefer, you can also type your message to Erica).

3.2.2. Disputing Transactions on Your Mobile Device

To access the credit card dispute process, log in to Mobile Banking.

3.3. Secure Messaging

Both the online and mobile platforms offer secure messaging for communicating with customer service.

- How to Use: Log in to your account, navigate to the “Contact Us” or “Help” section, and select the option to send a secure message.

- Benefits: Secure messaging is a safe way to discuss sensitive information, such as account details or disputes. You can also track your communication history.

3.4. Virtual Assistant: Erica

Erica is Bank of America’s virtual assistant, available through the mobile app.

- How to Access: Tap the Erica icon in the app.

- Capabilities: Ask questions, request transactions, and get personalized insights about your account.

4. Addressing Disputes and Fraudulent Activity

Dealing with fraudulent charges or billing errors can be stressful. Bank of America has processes in place to help you resolve these issues quickly and efficiently. This section outlines the steps to take if you suspect fraud or notice a discrepancy on your statement.

4.1. Immediately Reporting Lost or Stolen Cards

If your credit card is lost or stolen, report it immediately to prevent unauthorized charges.

- Call Customer Service: Use the dedicated 24/7 number: 800.732.9194.

- Online Reporting: Log in to Online Banking or the mobile app and report the card as lost or stolen.

4.2. Identifying Fraudulent Transactions

Regularly review your credit card statements for any unfamiliar transactions. Signs of fraud include:

- Unknown Merchants: Charges from businesses you don’t recognize.

- Unusual Amounts: Charges that are significantly different from your typical spending.

- Duplicate Charges: Multiple charges for the same transaction.

4.3. Steps to Dispute a Transaction

If you find a fraudulent or incorrect transaction, follow these steps:

- Contact the Merchant: Before initiating a claim, consider calling the merchant first, as they may resolve your claim faster (we may also require information from the merchant to process a claim, so contacting them directly may save you time). Additionally, please note that only posted transactions can be disputed (pending charges are temporary and may change), so if you have any immediate concerns about a pending charge, you may want to contact the merchant. You can typically find the merchant’s contact information on your receipt or billing statement.

- Gather Information: Collect all relevant details about the transaction, such as the date, amount, and merchant name.

- File a Dispute:

- Online: Log in to Online Banking or the mobile app and file a dispute through the transaction details page.

- Phone: Call the customer service number and speak to a representative.

- Mail: Send a written dispute to Bank of America (address provided in Section 5).

- Provide Documentation: Include any supporting documents, such as receipts or correspondence with the merchant.

4.4. What Happens After Filing a Dispute

Once you file a dispute, Bank of America will investigate the transaction.

- Temporary Credit: In some cases, a temporary credit may be issued to your account while the investigation is ongoing.

- Investigation Timeline: The investigation can take up to 60 days.

- Outcome Notification: You will be notified of the outcome of the investigation. If the dispute is resolved in your favor, the charge will be removed from your account.

4.5. Fraud Prevention Tips

To minimize the risk of fraud, consider these tips:

- Monitor Your Accounts Regularly: Check your credit card statements and online account activity frequently.

- Use Strong Passwords: Create strong, unique passwords for your online accounts.

- Be Cautious of Phishing: Avoid clicking on suspicious links or providing personal information in response to unsolicited emails or phone calls.

- Secure Your Card: Keep your credit card in a safe place and avoid sharing your card number.

- Sign Up for Alerts: Set up transaction alerts to receive notifications for unusual activity.

5. Contacting Bank of America by Mail

While digital and phone support are often quicker, sometimes you may need to contact Bank of America via mail. This section provides the necessary addresses for different types of inquiries.

5.1. Addresses for Different Inquiries

Here are the mailing addresses for various credit card-related matters:

- Credit Card Payments:

Bank of America

PO Box 15019

Wilmington, DE 19886-5019 - Express Overnight Service:

Payment Services

900 Samoset Drive

DE5-023-03-02

Newark, DE 19713-6000 - Credit Card Billing Inquiries:

Bank of America

PO Box 672050

Dallas, TX 75267-2050

5.2. When to Use Mail Communication

Mail communication is suitable for:

- Formal Disputes: Sending written disputes with detailed documentation.

- Complex Issues: Addressing complex issues that may require a written explanation.

- Official Correspondence: Sending official correspondence, such as legal notices.

5.3. Tips for Sending Mail

- Be Clear and Concise: Clearly state your issue or question.

- Include Relevant Information: Provide your account number, contact information, and any supporting documents.

- Keep a Copy: Make a copy of your letter and any enclosures for your records.

- Use Certified Mail: Consider sending your letter via certified mail with a return receipt to ensure it is received.

6. Additional Resources and Support

Beyond the standard customer service channels, Bank of America offers additional resources and support to help you manage your credit card account effectively.

6.1. Bank of America’s FAQ Section

The FAQ section on Bank of America’s website is a valuable resource for finding answers to common questions. Topics covered include:

- Account Management

- Billing and Payments

- Rewards Programs

- Security and Fraud Prevention

6.2. Financial Education Resources

Bank of America offers a variety of financial education resources to help you improve your financial literacy.

- Better Money Habits: This online platform provides articles, tools, and resources on various financial topics.

- Financial Literacy Programs: Bank of America supports various financial literacy programs in communities across the country.

6.3. Assistance Programs for Financial Hardship

If you’re facing financial hardship, Bank of America offers assistance programs to help you manage your credit card debt.

- Credit Card Assistance: Visit Bank of America’s credit card assistance page for information on available programs.

- Credit Counseling: Consider seeking assistance from a credit counselor to explore your options.

6.4. Finding ATMs and Financial Centers

Use Bank of America’s financial center locator to find a convenient location or ATM near you.

6.5. Scheduling an Appointment

Make an appointment to open an account or discuss your financial concerns at your convenience.

7. Social Media Customer Service

Many companies now offer customer service through social media platforms. Bank of America is active on social media and provides support through these channels.

7.1. Bank of America’s Social Media Presence

Bank of America has a presence on:

- X (formerly Twitter)

7.2. How to Contact Bank of America on Social Media

You can contact Bank of America’s customer service team through social media by:

- Sending a Private Message: Privately message them by selecting the Message button on their Facebook or Instagram page.

- Direct Messaging on X: Direct message @BofA_Help on X.

7.3. Tips for Using Social Media for Customer Service

- Be Clear and Concise: Clearly state your issue or question in your message.

- Include Relevant Information: Provide your name, ZIP code, phone number, and inquiry.

- Avoid Sharing Sensitive Information: Do not include account numbers or Social Security numbers in your messages for security reasons.

- Check for Verified Accounts: Ensure you are using Bank of America’s verified accounts to avoid scams.

Bank of America’s representatives are available on social media:

- Mon-Fri: 8 a.m. to 9 p.m. ET

- Sat: 9 a.m. to 6 p.m. ET

- Sun: 8 a.m. to 5 p.m. ET

8. Protecting Yourself from Fraudulent Emails

Phishing emails are a common tactic used by fraudsters to steal your personal information. Bank of America provides guidance on how to identify and avoid these scams.

8.1. Identifying Suspicious Emails

Be on the alert for emails that look suspicious. Signs of a fraudulent email include:

- Unusual Content: Poor spelling and grammar or words spelled in UK-style English.

- Urgent Call to Action: Demands for immediate action or threats of account closure.

- Suspicious Links: Links that redirect to unfamiliar websites or ask for personal information.

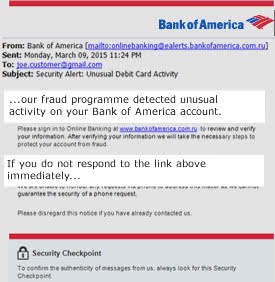

8.2. Example of a Fraudulent Email

A fraudulent email might say: “Our fraud program detected unusual activity on your Bank of America account. If you do not respond to the link above immediately…”

8.3. What to Do If You Receive a Suspicious Email

- Do Not Click on Links: Avoid clicking on any links in the email.

- Do Not Provide Personal Information: Never provide personal information, such as your account number or Social Security number, in response to an email.

- Report the Email: Forward the email to Bank of America at [email protected].

- Contact Bank of America: Call Bank of America’s customer service to report the suspicious email.

Example of Fraudulent Email

Example of Fraudulent Email

Example of a fraudulent email requesting immediate action due to unusual activity, urging caution.

9. Bank of America’s Commitment to Accessibility

Bank of America is committed to providing accessible services to all customers, including those with disabilities.

9.1. Relay Services

Bank of America accepts calls made through relay services. You can dial 711 to access these services.

9.2. Language Interpretation Services

Language interpretation services are available at no cost. You can request an interpreter at a financial center or when speaking with an agent on the phone.

9.3. Website Accessibility

Bank of America’s website is designed to be accessible to people with disabilities. Features include:

- Screen Reader Compatibility: The website is compatible with screen reader software.

- Keyboard Navigation: The website can be navigated using a keyboard.

- Alternative Text: Images have alternative text descriptions for screen reader users.

- Adjustable Font Sizes: Users can adjust the font size to improve readability.

10. Optimizing Your Bank of America Credit Card Experience

Effectively managing your Bank of America credit card involves more than just knowing how to contact customer service. It includes understanding your card’s features, managing your spending, and staying informed about security measures.

10.1. Understanding Your Credit Card Benefits

Take the time to understand the benefits offered by your Bank of America credit card. These may include:

- Rewards Programs: Cash back, travel points, or other rewards for your spending.

- Purchase Protection: Coverage for damaged or stolen items purchased with your card.

- Travel Insurance: Coverage for travel-related incidents, such as lost luggage or trip cancellation.

- Concierge Service: Assistance with travel planning, event tickets, and other services.

10.2. Managing Your Spending and Payments

Effective spending and payment habits are crucial for maintaining a healthy credit score.

- Create a Budget: Develop a budget to track your spending and avoid overspending.

- Pay Your Bills on Time: Set up automatic payments to ensure you never miss a due date.

- Pay More Than the Minimum: Paying more than the minimum payment can help you reduce your debt faster and save on interest charges.

- Monitor Your Credit Utilization: Keep your credit utilization (the amount of credit you’re using compared to your credit limit) low.

10.3. Staying Informed About Security Measures

Stay informed about the latest security measures and fraud prevention tips to protect your account.

- Sign Up for Alerts: Set up transaction alerts to receive notifications for unusual activity.

- Monitor Your Credit Report: Regularly check your credit report for any signs of identity theft.

- Use Secure Websites: Only use secure websites (those with “https” in the address) when making online purchases.

- Be Cautious of Public Wi-Fi: Avoid using public Wi-Fi networks for sensitive transactions.

11. Credit Card Application Status

If you applied for a Bank of America credit card online, you can check the status of your application online. You can also check the status by calling them at 866.422.8089.

12. Alternatives if Facing Credit Card Debt Obligations

If you’re having difficulty meeting your credit card debt obligations, please visit Bank of America’s credit card assistance page. You may also want to review these Better Money Habits articles:

- How to tackle financial stress

- Could a credit counselor help me?

13. CARS.EDU.VN: Your Trusted Resource for Automotive and Financial Guidance

At CARS.EDU.VN, we understand the importance of making informed decisions about your finances, especially when it comes to managing your credit card and vehicle-related expenses. We strive to provide you with the most accurate, up-to-date, and practical information to help you navigate the complexities of the automotive world and personal finance.

13.1. Comprehensive Automotive Information

CARS.EDU.VN is your go-to source for everything automotive, including:

- Detailed Car Reviews: In-depth reviews of the latest car models, covering performance, safety, reliability, and more.

- Maintenance Tips: Expert advice on how to keep your car running smoothly and avoid costly repairs.

- Repair Guides: Step-by-step guides for fixing common car problems, saving you time and money.

- Industry News: Stay up-to-date on the latest automotive trends, technologies, and regulations.

13.2. Financial Guidance for Car Owners

We also offer financial guidance tailored to car owners, including:

- Tips for Saving on Car Expenses: Learn how to reduce your car insurance premiums, find the best deals on gas, and more.

- Advice on Car Financing: Understand your car loan options and make informed decisions about financing your next vehicle.

- Strategies for Managing Car-Related Debt: Get help managing your car loan debt and other vehicle-related expenses.

13.3. Why Choose CARS.EDU.VN?

- Expert Advice: Our team of automotive and financial experts is dedicated to providing you with the best possible advice.

- Accurate Information: We strive to provide you with the most accurate and up-to-date information available.

- Practical Solutions: We offer practical solutions to help you save money, manage your finances, and get the most out of your car.

13.4. Call to Action

Are you struggling to find reliable car repair services or lacking the knowledge to maintain your vehicle properly? Do you find yourself overwhelmed when choosing the right car or dealing with unexpected car troubles? Visit CARS.EDU.VN today to discover a wealth of information and resources designed to make car ownership easier and more affordable.

Explore our website to find detailed guides on car maintenance, expert reviews of new models, and practical tips for saving money on car expenses. Let CARS.EDU.VN be your trusted companion on your automotive journey, providing the knowledge and support you need to make informed decisions and enjoy a smoother, more secure ride.

Contact Information:

- Address: 456 Auto Drive, Anytown, CA 90210, United States

- WhatsApp: +1 555-123-4567

- Website: cars.edu.vn

FAQ: Bank of America Credit Card Customer Care

Here are some frequently asked questions about Bank of America credit card customer care:

- What is the Bank of America credit card customer service number?

- The main customer service number is 800.732.9194.

- How can I report a lost or stolen Bank of America credit card?

- Call 800.732.9194 immediately to report a lost or stolen card.

- How do I dispute a transaction on my Bank of America credit card?

- Log in to Online Banking or the mobile app to file a dispute, or call customer service.

- Can I check my Bank of America credit card balance online?

- Yes, you can check your balance by logging in to Online Banking or the mobile app.

- Does Bank of America offer language interpretation services?

- Yes, language interpretation services are available at no cost.

- How can I avoid fraudulent emails targeting Bank of America customers?

- Be cautious of suspicious emails, do not click on links, and report any suspicious emails to [email protected].

- What should I do if I’m having trouble paying my Bank of America credit card bill?

- Visit Bank of America’s credit card assistance page or seek assistance from a credit counselor.

- How can I find a Bank of America ATM or financial center near me?

- Use the financial center locator on Bank of America’s website.

- Can I contact Bank of America customer service through social media?

- Yes, you can contact Bank of America through Facebook, Instagram, or X.

- Is Bank of America’s website accessible to people with disabilities?

- Yes, Bank of America’s website is designed to be accessible, with features like screen reader compatibility and adjustable font sizes.