How Much Is Car Registration In Illinois? Navigating vehicle registration and renewal costs in Illinois can be complex, but CARS.EDU.VN simplifies it for you. This guide offers a detailed breakdown of Illinois car registration fees, factors influencing the cost, and ways to potentially save money, ensuring you stay informed and compliant with Illinois vehicle regulations. Understanding these car ownership expenses helps you budget wisely and make informed decisions.

1. Understanding Illinois Vehicle Registration Fees

Registering your vehicle in Illinois involves several fees that contribute to the overall cost. These fees support state infrastructure and transportation projects. Understanding these costs upfront helps Illinois drivers budget effectively and avoid surprises.

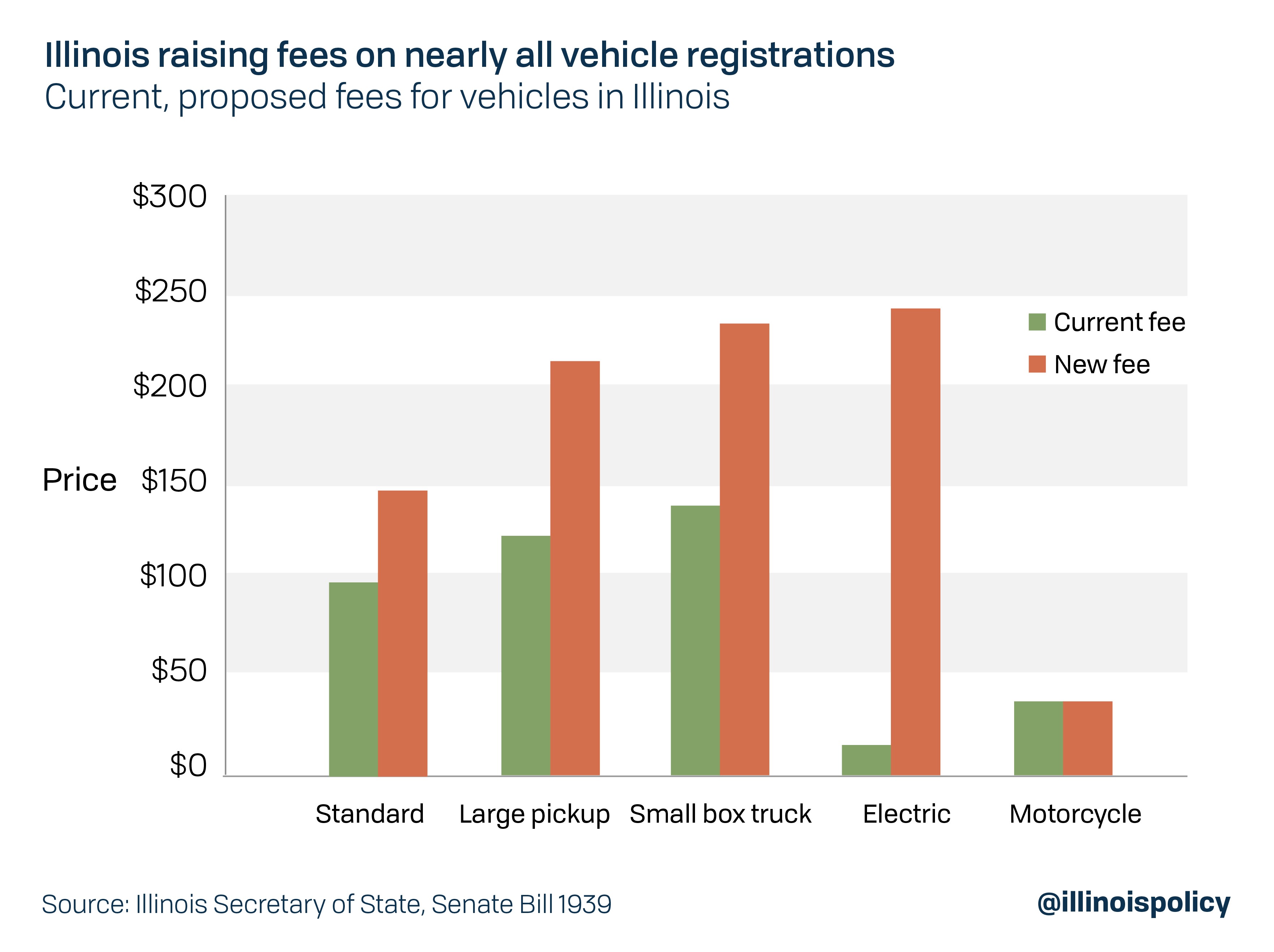

- Base Registration Fee: The base vehicle registration fee in Illinois for standard vehicles weighing 8,000 pounds or less is $148 per year. This fee significantly increased from $98 as part of a 2019 infrastructure plan aimed at improving roads and transportation systems throughout the state, according to the Illinois Policy Institute.

- Vehicle Type: Different types of vehicles incur different registration fees. Larger vehicles, such as trailers and buses, have seen increases of $100 in their registration fees. Electric vehicles now face a $248 annual registration fee, a substantial increase from the previous $35 every two years.

- Other Fees: Besides the base registration fee, additional fees may apply depending on the specifics of your vehicle and situation. These could include title fees, processing fees, and other miscellaneous charges. Always check the latest official information on the Illinois Secretary of State’s website or CARS.EDU.VN for an exhaustive rundown.

2. Factors Influencing Car Registration Costs in Illinois

Several factors can influence the amount you’ll pay for car registration in Illinois. Being aware of these elements can help you estimate your registration costs more accurately.

- Vehicle Weight: Illinois charges different registration fees based on vehicle weight. Standard passenger vehicles, usually under 8,000 pounds, have a flat fee. Heavier vehicles, like trucks and buses, incur higher fees.

- Electric vs. Gas-Powered Vehicles: As mentioned earlier, electric vehicles in Illinois have a significantly higher annual registration fee compared to gas-powered vehicles. This fee is intended to offset the lack of gas tax revenue that electric vehicles contribute, which is used to fund road maintenance and construction.

- Location Within Illinois: While the base registration fee is consistent statewide, local county or municipal taxes may add to the overall cost. These local fees vary depending on where you live and can impact the total amount due.

- Vehicle Age: Illinois does not typically factor in vehicle age when determining registration fees. Unlike some states that offer discounts for older vehicles, Illinois primarily considers the type and weight of the vehicle.

- Late Penalties: Registering your vehicle on time is crucial to avoid late penalties. Illinois imposes fines for late registration, which can increase the overall cost. Make sure to renew your registration before the expiration date to avoid these charges.

3. Step-by-Step Guide to Registering Your Car in Illinois

Registering your car in Illinois involves a straightforward process. Here’s a detailed, step-by-step guide to help you navigate it successfully:

-

Gather Required Documents: Before heading to a registration office, gather all necessary documents. Generally, you’ll need:

- The vehicle’s title or proof of ownership.

- A completed Application for Vehicle Transaction(s) (Form VSD-190).

- Proof of Illinois auto insurance.

- A valid driver’s license or state ID.

- Payment for registration fees and taxes.

-

Visit a Local SOS Office: Visit a local office of the Illinois Secretary of State (SOS). You can find the nearest location on the SOS website. Be prepared to wait in line, as these offices can be busy.

-

Submit Your Documents: Submit all your documents to the clerk at the SOS office. They will review your paperwork and verify the information.

-

Pay the Fees: Pay the required registration fees and any applicable taxes. The SOS office accepts various payment methods, including cash, checks, money orders, and credit/debit cards.

-

Receive Your Registration and Plates: Once your payment is processed, you’ll receive your vehicle registration certificate and license plates (if applicable). Affix the license plates to your vehicle and keep the registration certificate in your car as proof of registration.

-

Renewing Your Registration: Illinois vehicle registrations are typically valid for one year. You’ll receive a renewal notice in the mail before your registration expires. You can renew online, by mail, or in person at an SOS office. Make sure to renew on time to avoid late fees.

By following these steps, you can register your vehicle in Illinois quickly and efficiently. Always double-check the requirements and fees on the Illinois Secretary of State’s website or CARS.EDU.VN, as they may change.

4. Comparing Illinois Car Registration Fees to Neighboring States

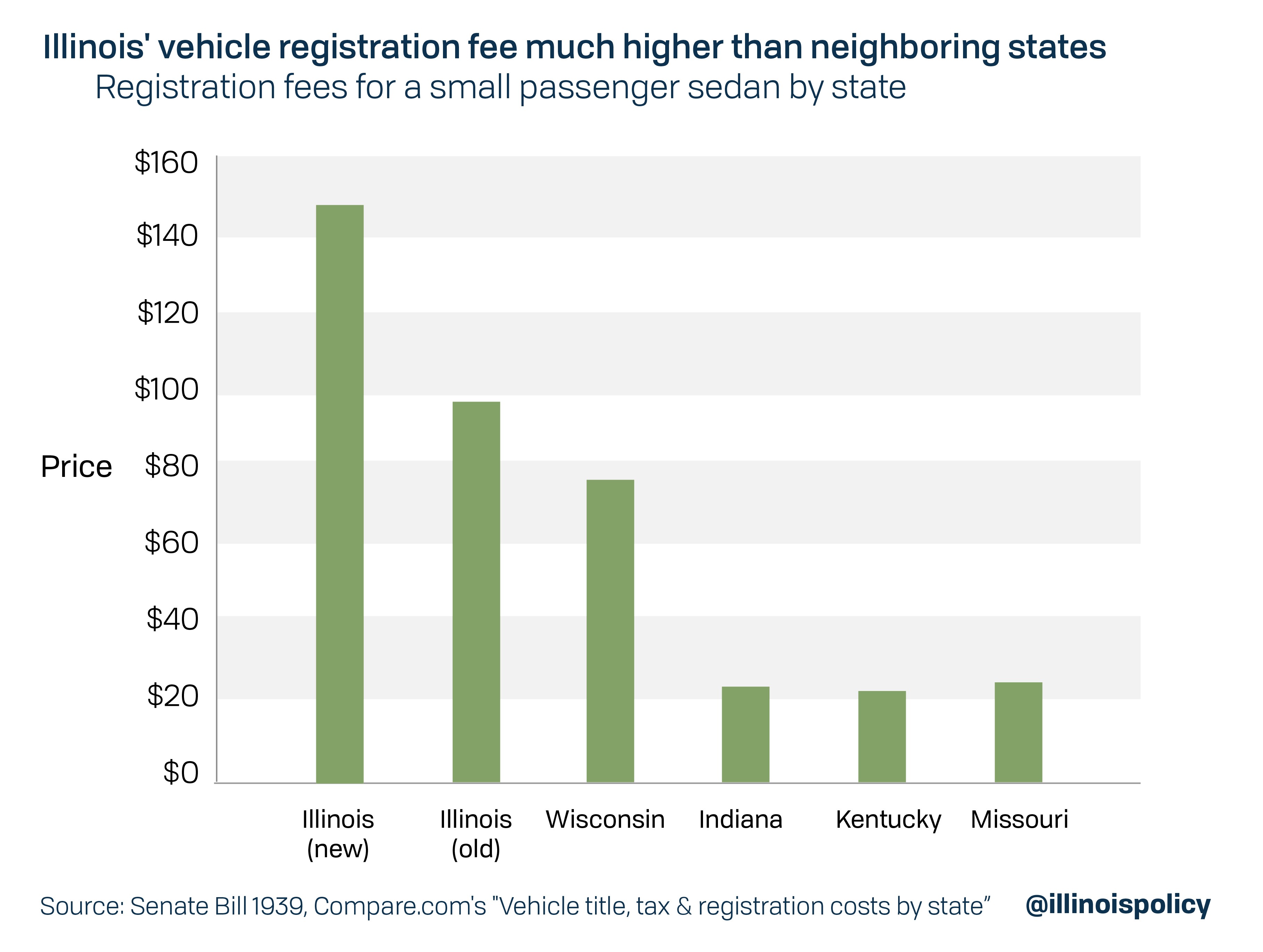

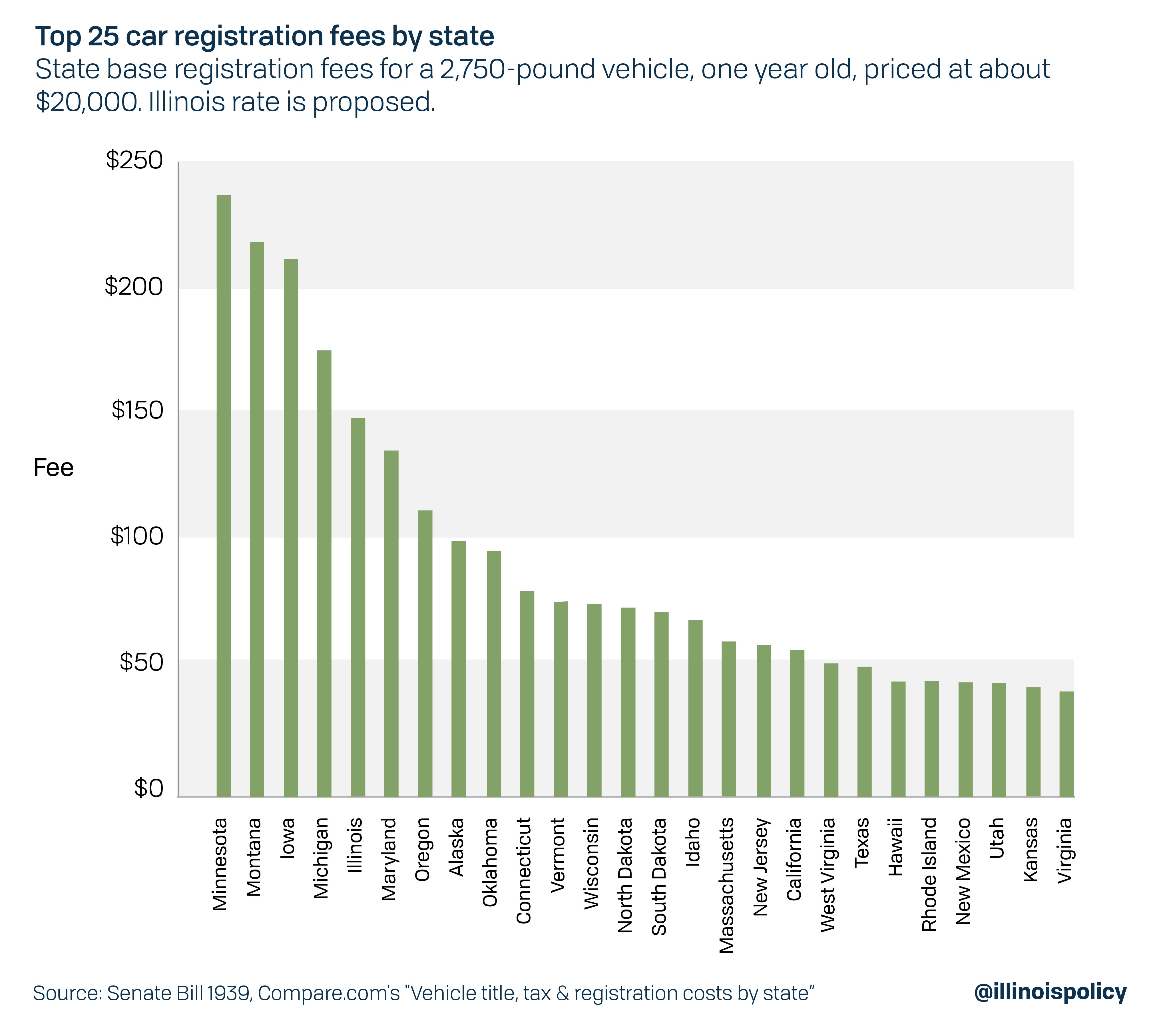

When comparing Illinois car registration fees to those of neighboring states, it becomes clear that Illinois has some of the highest costs. This comparison can help Illinois residents understand where they stand and potentially influence decisions about vehicle ownership.

| State | Registration Fee Details |

|---|---|

| Illinois | $148 flat fee for standard vehicles; $248 for electric vehicles. |

| Indiana | Fees vary by vehicle type and weight. Passenger vehicles typically range from $21.35 to $41.35 annually. |

| Wisconsin | Fees vary by vehicle weight. Passenger vehicles typically range from $85 to $100 annually. |

| Iowa | Fees are calculated based on vehicle weight and list price percentage, varying by age. For a standard sedan, it can range from $70 to $120 annually. |

| Missouri | Fees are based on horsepower. A typical passenger vehicle can range from $18.75 to $85 annually. |

| Kentucky | $21 for all passenger vehicles annually. |

| Michigan | The registration tax is based on the vehicle’s value when new. The tax decreases each year based on the car’s age. For passenger vehicles, prices range from around $80 for newer cars to $30 for older ones. These are annual registration fees. |

As shown in the table, Illinois has a flat fee of $148 for standard vehicles and $248 for electric vehicles, which is notably higher than many of its neighboring states. For example, Indiana charges between $21.35 and $41.35 for passenger vehicles, while Kentucky charges only $21 annually. This significant difference can make Illinois a more expensive state for vehicle owners.

5. Potential Penalties for Late Car Registration in Illinois

Late car registration in Illinois can lead to various penalties. Knowing these penalties can motivate vehicle owners to renew their registration on time and avoid unnecessary expenses.

- Late Fee: Illinois imposes a late fee for renewing your vehicle registration after the expiration date. As of 2023, this fee is $20 for registrations renewed within 30 days of the expiration date.

- Increased Fees Over Time: If you wait longer than 30 days to renew, the penalties can increase. The longer you delay, the higher the fines, making it essential to renew as soon as possible.

- Suspension of Driving Privileges: Driving with an expired registration can lead to the suspension of your driving privileges. Law enforcement may issue tickets or citations, which can result in additional fines and points on your driving record.

- Vehicle Impoundment: In some cases, driving with an expired registration can lead to your vehicle being impounded. This not only results in fines and penalties but also incurs towing and storage fees.

- Legal Consequences: Continued failure to register your vehicle can lead to more severe legal consequences, including court appearances and a criminal record.

To avoid these penalties, always renew your vehicle registration before the expiration date. Illinois sends out renewal notices as a reminder, but it is ultimately the vehicle owner’s responsibility to ensure timely renewal.

6. How to Renew Your Car Registration in Illinois

Renewing your car registration in Illinois can be done through several convenient methods. Here’s a guide on how to renew your registration online, by mail, or in person.

- Online Renewal: The Illinois Secretary of State (SOS) offers an online renewal service, which is the most convenient option for many vehicle owners.

- Visit the Illinois SOS website.

- Locate the online vehicle registration renewal section.

- Enter your registration information, including your license plate number and Vehicle Identification Number (VIN).

- Verify your information and pay the renewal fee using a credit or debit card.

- Print your temporary registration card and wait for the official sticker to arrive in the mail.

- Renewal by Mail: If you prefer to renew by mail, follow these steps:

- Wait for your renewal notice to arrive in the mail.

- Complete the renewal form included in the notice.

- Make a check or money order payable to the Illinois Secretary of State for the renewal fee.

- Mail the completed form and payment to the address provided on the renewal notice.

- Wait for your new registration sticker to arrive in the mail.

- In-Person Renewal: You can also renew your vehicle registration in person at a local SOS office.

- Visit a local SOS office.

- Bring your renewal notice and a valid form of identification.

- Complete the renewal form available at the office.

- Pay the renewal fee using cash, check, money order, or credit/debit card.

- Receive your new registration sticker immediately.

Renewing your car registration in Illinois is a straightforward process. Choose the method that works best for you and ensure you renew on time to avoid late fees and penalties.

7. Understanding Illinois License Plate Requirements

Understanding Illinois license plate requirements is essential for all vehicle owners in the state. Compliance with these requirements ensures you avoid legal issues and maintain vehicle registration validity.

- Display Requirements: Illinois requires vehicles to display two license plates—one on the front and one on the rear of the vehicle. The plates must be securely fastened and clearly visible.

- Plate Visibility: License plates must be free from any obstructions that could hinder their visibility. This includes dirt, debris, or license plate covers that distort or obscure the plate numbers and letters.

- Plate Condition: License plates must be in good condition and legible. Damaged or defaced plates may need to be replaced. Contact the Illinois Secretary of State (SOS) for information on obtaining replacement plates.

- Renewal Stickers: Illinois license plates require current registration stickers to be displayed in the designated corner of the rear plate. Ensure your registration sticker is up-to-date and properly affixed to avoid penalties.

- Specialty Plates: Illinois offers a variety of specialty license plates, including organizational, military, and personalized plates. These plates may have additional fees and requirements. Check the SOS website for details.

Adhering to Illinois license plate requirements ensures you comply with state laws and avoid fines or other legal issues. Always keep your plates clean, visible, and properly displayed.

8. Tips for Saving Money on Car Registration in Illinois

While car registration fees in Illinois are relatively high, there are some strategies you can use to potentially save money. Here are some tips to help lower your vehicle registration costs.

- Renew on Time: Avoid late fees by renewing your vehicle registration before the expiration date. Set reminders or sign up for email notifications to ensure you don’t miss the deadline.

- Consider Vehicle Type: If you’re planning to purchase a new vehicle, consider the registration fees associated with different types of vehicles. Smaller, lighter vehicles generally have lower registration costs than larger, heavier ones.

- Check for Exemptions: Certain individuals may qualify for exemptions or reduced registration fees. This includes veterans, disabled individuals, and senior citizens. Check the Illinois Secretary of State’s website to see if you’re eligible.

- Maintain Vehicle Condition: Keeping your vehicle in good condition can prevent issues that may lead to fines or penalties. Ensure your license plates are visible and your vehicle meets all safety requirements.

- Review Insurance Options: While insurance costs are separate from registration fees, they are a significant part of vehicle ownership expenses. Review your insurance options to ensure you’re getting the best rate possible.

- Carpooling and Public Transportation: Consider carpooling or using public transportation to reduce the need to drive your vehicle regularly. This can lower wear and tear and potentially extend the lifespan of your vehicle, delaying the need for replacement.

By following these tips, you can potentially save money on car registration and other vehicle-related expenses in Illinois. Always stay informed about the latest fees and regulations to make the most cost-effective choices.

9. Understanding the Illinois Gas Tax and Its Impact on Car Owners

The Illinois gas tax is a significant factor affecting the overall cost of owning and operating a vehicle in the state. Understanding how this tax works and its implications can help car owners make informed decisions about their transportation expenses.

- Gas Tax Rate: As of 2019, Illinois doubled its gas tax to 38 cents per gallon, making it one of the highest gas taxes in the nation. This increase was part of a comprehensive infrastructure plan aimed at funding road and bridge improvements throughout the state.

- Impact on Fuel Costs: The gas tax directly impacts the price you pay at the pump. Higher gas taxes mean higher fuel costs, which can significantly affect your monthly budget, especially if you drive frequently.

- Funding for Infrastructure: The revenue generated from the gas tax is used to fund various transportation projects, including road construction, maintenance, and repairs. These projects aim to improve the state’s infrastructure and enhance safety for drivers.

- Comparison with Other States: Illinois’ gas tax is notably higher than many of its neighboring states. This can make driving in Illinois more expensive compared to other regions.

- Alternative Fuel Vehicles: Owners of alternative fuel vehicles, such as electric vehicles, may pay different fees to compensate for the lack of gas tax revenue. As mentioned earlier, electric vehicles in Illinois face a higher annual registration fee.

Being aware of the Illinois gas tax and its implications can help you better manage your vehicle-related expenses. Consider fuel-efficient vehicles, carpooling, or public transportation to reduce your reliance on gasoline and mitigate the impact of the gas tax.

10. The Future of Car Registration Fees in Illinois

The future of car registration fees in Illinois is subject to change, influenced by factors such as state budget needs, infrastructure projects, and policy decisions. Staying informed about potential changes can help you prepare for future expenses.

- Potential Fee Adjustments: Car registration fees in Illinois may be adjusted in the future to address budget shortfalls or fund new transportation initiatives. Keep an eye on legislative developments and announcements from the Illinois Secretary of State’s office.

- Infrastructure Plans: Ongoing and future infrastructure plans can impact car registration fees. If the state needs additional funding for road and bridge improvements, fees may increase to support these projects.

- Electric Vehicle Policies: As electric vehicles become more prevalent, Illinois may adjust its policies regarding registration fees for these vehicles. This could involve changes to the annual fee or the introduction of new incentives to promote EV adoption.

- Legislative Changes: Changes to state laws can directly affect car registration fees. Monitor legislative sessions and proposed bills that could impact vehicle-related costs.

- Economic Factors: Economic conditions can also influence car registration fees. During times of economic hardship, the state may adjust fees to generate revenue or provide relief to vehicle owners.

Staying informed about these factors can help you anticipate potential changes in car registration fees and plan your budget accordingly. Regularly check the Illinois Secretary of State’s website or CARS.EDU.VN for updates and announcements.

11. Common Mistakes to Avoid During Car Registration in Illinois

Registering a car in Illinois can be straightforward, but it’s easy to make mistakes that can cause delays or additional costs. Here are some common errors to avoid:

- Incomplete Paperwork: Make sure you fill out all required forms completely and accurately. Missing information can lead to rejection of your application.

- Incorrect Information: Double-check all information you provide, including your name, address, vehicle details, and VIN. Errors can cause delays and require corrections.

- Expired Documents: Ensure all your documents, such as your driver’s license and insurance card, are current and valid. Expired documents will not be accepted.

- Missing Proof of Insurance: Illinois requires proof of auto insurance to register a vehicle. Make sure you have a valid insurance card or policy document.

- Failure to Pay Fees: Be prepared to pay all required registration fees and taxes. Insufficient payment will prevent you from completing the registration process.

- Ignoring Renewal Notices: Pay attention to renewal notices and renew your registration on time to avoid late fees and penalties.

- Improper Plate Display: Make sure your license plates are properly displayed and visible. Obstructed or damaged plates can lead to fines.

- Not Updating Address: If you move, update your address with the Illinois Secretary of State promptly to ensure you receive important notices and documents.

- Skipping Vehicle Inspection: Certain vehicles may require an inspection before registration. Check if your vehicle needs an inspection and complete it before applying for registration.

- Misunderstanding Registration Requirements: Take the time to understand the specific registration requirements for your vehicle type and situation. Contact the SOS or visit their website for clarification if needed.

By avoiding these common mistakes, you can ensure a smooth and hassle-free car registration process in Illinois.

12. Special Considerations for New Illinois Residents

If you’re a new resident of Illinois, there are specific steps you need to take to register your vehicle and obtain Illinois license plates. Here’s what you need to know:

- Residency Requirement: New Illinois residents typically have 30 days to register their vehicles after establishing residency.

- Obtain an Illinois Driver’s License: Before registering your vehicle, you’ll need to obtain an Illinois driver’s license. Visit a local SOS office to apply for a license and pass any required tests.

- Vehicle Inspection: Some vehicles may require an inspection before registration. Check with the SOS to see if your vehicle needs an inspection and where to get it done.

- Title Transfer: Transfer your vehicle’s title to Illinois. This involves submitting your out-of-state title to the SOS along with an Application for Vehicle Transaction(s) (Form VSD-190).

- Proof of Insurance: Provide proof of Illinois auto insurance. Your insurance policy must meet the state’s minimum coverage requirements.

- Vehicle Registration: Register your vehicle at a local SOS office. You’ll need to submit the required documents, including your title, driver’s license, proof of insurance, and payment for registration fees and taxes.

- License Plates: Obtain Illinois license plates for your vehicle. You’ll receive the plates at the SOS office after completing the registration process.

- Pay Fees and Taxes: Be prepared to pay all applicable fees and taxes, including registration fees, title transfer fees, and any local taxes.

By following these steps, new Illinois residents can successfully register their vehicles and comply with state laws.

13. How CARS.EDU.VN Can Help You Navigate Car Ownership in Illinois

CARS.EDU.VN is dedicated to providing comprehensive and reliable information to help you navigate all aspects of car ownership in Illinois. From understanding registration fees to finding the best service and repair options, CARS.EDU.VN is your trusted resource.

- Detailed Guides: Access detailed guides on various topics related to car ownership, including registration, maintenance, repairs, and more.

- Expert Reviews: Read expert reviews and comparisons of different vehicle models to help you make informed purchasing decisions.

- Maintenance Tips: Learn valuable maintenance tips to keep your vehicle running smoothly and avoid costly repairs.

- Repair Advice: Get advice on how to handle common car repairs and find reputable mechanics in your area.

- Cost Estimates: Use our cost estimation tools to budget for vehicle registration, insurance, maintenance, and repairs.

- News and Updates: Stay up-to-date with the latest news and updates in the automotive industry, including changes to Illinois vehicle laws and regulations.

- Community Forum: Join our community forum to connect with other car owners, share experiences, and get answers to your questions.

- Resource Directory: Find a directory of useful resources, including local SOS offices, inspection stations, and auto service providers.

- Contact Information: For personalized assistance, you can reach us at 456 Auto Drive, Anytown, CA 90210, United States. Whatsapp: +1 555-123-4567. Website: CARS.EDU.VN.

CARS.EDU.VN is committed to providing you with the information and resources you need to confidently navigate car ownership in Illinois.

14. Understanding Personalized and Vanity License Plates in Illinois

Illinois offers personalized and vanity license plates that allow vehicle owners to customize their vehicles with unique combinations of letters and numbers. Understanding the rules and fees associated with these plates can help you decide if they are right for you.

- Definition: Personalized plates feature a specific combination of letters and numbers chosen by the vehicle owner, while vanity plates often spell out a word or phrase.

- Availability: Personalized and vanity plates are subject to availability. The requested combination must not be offensive, misleading, or already in use.

- Application Process: To apply for a personalized or vanity plate, you’ll need to complete an application form and submit it to the Illinois Secretary of State (SOS). You can apply online or by mail.

- Fees: Personalized and vanity plates come with additional fees on top of the standard registration fees. These fees vary depending on the type of plate and the number of characters.

- Renewal: Personalized and vanity plates must be renewed annually along with your vehicle registration. Renewal fees may be higher than standard plates.

- Restrictions: There are restrictions on the types of combinations allowed on personalized and vanity plates. The SOS has the right to reject any combination that violates its guidelines.

- Transfer: Personalized and vanity plates can be transferred to another vehicle owned by the same person. However, you’ll need to complete a transfer application and pay any applicable fees.

- Benefits: Personalized and vanity plates allow you to express your individuality and customize your vehicle. They can also make your vehicle easier to identify.

If you’re interested in obtaining a personalized or vanity plate in Illinois, visit the SOS website for more information and to check the availability of your desired combination.

15. Illinois Vehicle Registration for Military Personnel

Illinois offers specific vehicle registration benefits and considerations for military personnel stationed in or residing in the state. Understanding these provisions can help military members comply with Illinois law while serving their country.

- Exemption from Registration: Military personnel stationed in Illinois but not considered legal residents may be exempt from registering their vehicles in the state, provided they maintain valid registration from their home state.

- Non-Resident Status: To qualify for this exemption, military members must provide proof of their non-resident status and valid registration from their home state.

- Illinois Residency: Military personnel who establish residency in Illinois must register their vehicles in the state and obtain Illinois license plates.

- Military License Plates: Illinois offers special military license plates to honor the service of military members and veterans. These plates may have additional fees and requirements.

- Renewal by Mail: Military personnel stationed outside of Illinois can typically renew their vehicle registration by mail. Contact the Illinois Secretary of State (SOS) for instructions on how to renew by mail.

- Power of Attorney: If a military member is unable to register their vehicle in person, they can designate someone to act on their behalf using a power of attorney.

- Tax Exemptions: Some military members may be eligible for tax exemptions on vehicle purchases or registration fees. Check with the Illinois Department of Revenue for more information.

Illinois is committed to supporting military personnel and providing them with the resources they need to comply with vehicle registration laws. Visit the SOS website or CARS.EDU.VN for more information on military-related vehicle registration matters.

16. Environmental Considerations and Vehicle Registration in Illinois

Environmental considerations are becoming increasingly important in the automotive industry, and Illinois is taking steps to promote environmentally friendly vehicles through its registration policies.

- Electric Vehicle Incentives: Illinois offers incentives to encourage the adoption of electric vehicles (EVs), including rebates and tax credits. These incentives can help offset the higher purchase price of EVs and make them more accessible to consumers.

- Reduced Emissions Testing: Some environmentally friendly vehicles may be exempt from emissions testing requirements. Check with the Illinois Environmental Protection Agency (IEPA) to see if your vehicle qualifies.

- Alternative Fuel Vehicles: Illinois supports the use of alternative fuel vehicles, such as those powered by natural gas or propane. These vehicles may be eligible for certain registration benefits.

- Clean Car Standards: Illinois follows California’s clean car standards, which set strict emissions limits for new vehicles sold in the state. These standards help reduce air pollution and promote cleaner transportation.

- Vehicle Scrapping Programs: Illinois may offer vehicle scrapping programs to encourage the retirement of older, polluting vehicles. These programs provide financial incentives to vehicle owners who voluntarily scrap their vehicles.

- Sustainable Transportation: Illinois promotes sustainable transportation options, such as public transit, biking, and walking. These options can help reduce traffic congestion and improve air quality.

By promoting environmentally friendly vehicles and sustainable transportation practices, Illinois is working to create a cleaner and healthier environment for its residents.

17. The Role of Vehicle Inspections in Illinois Registration

Vehicle inspections play a crucial role in ensuring road safety and environmental compliance in Illinois. Understanding the inspection requirements can help you maintain your vehicle and avoid registration issues.

- Safety Inspections: Illinois requires safety inspections for certain vehicles, including those being registered for the first time in the state and those that have been involved in accidents.

- Emissions Testing: Illinois also requires emissions testing for vehicles in certain counties to ensure they meet air quality standards. The counties subject to emissions testing may change, so check with the Illinois Environmental Protection Agency (IEPA) for the latest information.

- Inspection Requirements: During a vehicle inspection, a certified technician will check various components, including brakes, lights, steering, suspension, and emissions control systems.

- Inspection Results: If your vehicle passes inspection, you’ll receive a certificate that you can use to register your vehicle. If your vehicle fails inspection, you’ll need to have the necessary repairs made and pass a re-inspection.

- Inspection Stations: Vehicle inspections must be performed at authorized inspection stations. You can find a list of authorized stations on the IEPA website.

- Exemptions: Certain vehicles may be exempt from inspection requirements, such as new vehicles, motorcycles, and those that are less than four years old.

- Fees: Vehicle inspections typically involve a fee. The fee may vary depending on the type of inspection and the inspection station.

- Benefits of Inspections: Vehicle inspections help ensure that vehicles on Illinois roads are safe and environmentally sound. They can also help identify potential problems before they become major issues.

By complying with vehicle inspection requirements, you can help keep Illinois roads safe and protect the environment.

18. How to Handle a Lost or Stolen Vehicle Registration in Illinois

Losing your vehicle registration can be stressful, but Illinois provides a process for obtaining a replacement. Here’s how to handle a lost or stolen vehicle registration:

- Report the Loss: If your vehicle registration is lost or stolen, report the loss to the Illinois Secretary of State (SOS) as soon as possible.

- Application for Replacement: Complete an Application for Vehicle Transaction(s) (Form VSD-190) to request a replacement registration. You can download the form from the SOS website or obtain it at a local SOS office.

- Required Documents: Submit the completed application along with a copy of your driver’s license or state ID and proof of vehicle ownership, such as your vehicle title or current registration card (if available).

- Fees: Pay the required fee for a replacement registration. The fee is typically nominal.

- Submission Methods: You can submit your application and documents in person at a local SOS office or by mail to the address provided on the application form.

- Temporary Registration: In some cases, you may be able to obtain a temporary registration card while you wait for your replacement registration to arrive.

- Prevention Tips: To prevent losing your vehicle registration, keep it in a safe place in your vehicle, such as your glove compartment or owner’s manual. Consider making a photocopy of your registration for your records.

By following these steps, you can quickly and easily replace a lost or stolen vehicle registration in Illinois.

19. Navigating Illinois Vehicle Title Transfers

Transferring a vehicle title in Illinois is a critical step when buying or selling a vehicle. Here’s a guide to help you navigate the title transfer process:

- Seller Responsibilities: As the seller, you must complete the assignment section on the back of the vehicle title. This includes providing the buyer’s name, address, and the sale price of the vehicle.

- Odometer Disclosure: Complete the odometer disclosure section on the title, indicating the vehicle’s mileage at the time of sale.

- Buyer Responsibilities: As the buyer, you must apply for a new title in your name within a certain timeframe, typically 30 days from the date of sale.

- Application for Title: Complete an Application for Vehicle Transaction(s) (Form VSD-190) to apply for a new title. You can download the form from the SOS website or obtain it at a local SOS office.

- Required Documents: Submit the completed application along with the original vehicle title, a copy of your driver’s license or state ID, proof of Illinois auto insurance, and payment for title transfer fees and taxes.

- Vehicle Inspection: Some vehicles may require an inspection before the title can be transferred. Check with the SOS to see if your vehicle needs an inspection.

- Lien Release: If there is a lien on the vehicle, obtain a lien release from the lender before transferring the title.

- Submission Methods: You can submit your application and documents in person at a local SOS office.

- Title Fees and Taxes: Be prepared to pay title transfer fees and any applicable taxes, such as sales tax.

By following these steps, you can successfully transfer a vehicle title in Illinois and ensure that the vehicle is legally registered in the new owner’s name.

20. Frequently Asked Questions (FAQs) About Car Registration in Illinois

Here are some frequently asked questions about car registration in Illinois:

- How much does it cost to register a car in Illinois?

- The base registration fee for standard vehicles is $148 per year.

- How often do I need to renew my car registration?

- Vehicle registrations in Illinois are typically valid for one year.

- What documents do I need to register my car?

- You’ll need the vehicle title, a completed application form, proof of insurance, and a valid driver’s license.

- Can I renew my car registration online?

- Yes, you can renew your registration online through the Illinois Secretary of State’s website.

- What happens if I don’t renew my registration on time?

- You’ll incur a late fee, and you could face additional penalties, including suspension of your driving privileges.

- Do I need to display license plates on the front and back of my car?

- Yes, Illinois requires vehicles to display license plates on both the front and rear of the vehicle.

- Are electric vehicles subject to the same registration fees as gas-powered vehicles?

- No, electric vehicles in Illinois have a higher annual registration fee.

- How do I transfer a vehicle title in Illinois?

- You’ll need to complete the assignment section on the title and submit it to the SOS along with a completed application form and other required documents.

- What should I do if I lose my vehicle registration?

- Report the loss to the SOS and apply for a replacement registration.

- Where can I find more information about car registration in Illinois?

- Visit the Illinois Secretary of State’s website or CARS.EDU.VN for detailed information and resources.

Navigating car registration in Illinois can be complex, but CARS.EDU.VN is here to help. If you’re facing challenges finding reliable repair services or understanding maintenance needs, visit cars.edu.vn for expert guidance. We provide detailed service information, car comparisons, and troubleshooting advice to help you make informed decisions. Contact us at 456 Auto Drive, Anytown, CA 90210, United States. Whatsapp: +1 555-123-4567.