The United States stands out globally for its exorbitant healthcare spending per person, yet paradoxically, millions of Americans struggle to access adequate medical care. Over 37 million individuals lack health insurance entirely, and an additional 41 million face insufficient coverage, creating a stark reality of healthcare inequity. Against a backdrop of ongoing debates about repealing the Affordable Care Act (ACA) and its implications for coverage, proposals for universal healthcare systems, such as the Medicare for All Act (MAA), have gained prominence. The central question in these discussions often revolves around finances: How Much Will Universal Health Care Cost, and can the nation afford it? This article delves into the economic implications of universal healthcare, exploring the potential costs and, crucially, the significant savings that a single-payer system like MAA could generate. We will analyze projections, examine potential impacts on national expenditure, and ultimately assess the financial feasibility and benefits of ensuring healthcare for every American.

Understanding the Current US Healthcare Cost Crisis

Before assessing the costs of universal healthcare, it’s crucial to understand the financial landscape of the current US healthcare system. Despite leading the world in healthcare expenditure, allocating approximately 18% of its GDP to this sector, the US lags behind numerous developed nations in key public health indicators. These include preventable deaths, infant and maternal mortality rates, and overall life expectancy. This disconnect highlights a fundamental inefficiency: the US spends more but achieves less in terms of health outcomes compared to many other countries. A significant portion of this high spending is attributed to a complex web of private insurance, administrative overhead, and inflated prices for services and pharmaceuticals. Millions of Americans face high premiums, deductibles, and out-of-pocket costs, creating barriers to necessary care even for those with insurance. This system not only burdens individuals and families but also contributes to economic instability and reduced productivity.

The Medicare for All Act (MAA): A Model for Cost Savings

The Medicare for All Act (MAA) proposes a single-payer universal healthcare system, aiming to transform the US healthcare landscape. At its core, MAA seeks to provide comprehensive health coverage to all Americans, funded through public means, similar to the existing Medicare system for seniors. While the initial question might be about the increased costs of covering everyone, a deeper analysis reveals substantial avenues for cost savings within such a system. These savings are projected to arise from several key areas: reduced administrative complexity, lower fees for services, negotiated pharmaceutical prices, and fraud reduction. Let’s examine these potential savings in detail, addressing the crucial question: how much will universal health care cost under a MAA-like system, and how can it potentially lead to net savings?

Streamlining Costs: Reduced Hospital and Clinical Fees

One of the primary mechanisms for cost reduction under MAA is the implementation of a unified fee schedule for hospital and clinical services, based on existing Medicare rates. Currently, the US healthcare system is characterized by a fragmented pricing structure, where private insurers negotiate varying rates with hospitals and providers. This lack of transparency and standardization leads to significant price variations, often unrelated to the quality of care provided. For example, the cost of common procedures can vary dramatically across different regions and hospitals, with little correlation to patient outcomes. Medicare, on the other hand, operates with a fixed fee schedule, generally lower than those negotiated by private insurers. By extending Medicare rates to all healthcare services, MAA aims to significantly reduce overall expenditure. Studies project that applying Medicare fee schedules could reduce hospital fees by approximately 5.54% and clinical service fees by 7.38%, resulting in substantial annual savings. While healthcare providers might initially be concerned about reduced per-service fees, these reductions are expected to be offset by significant savings in administrative costs and the elimination of unpaid bills, as we will explore further.

Efficiency Gains: Unified Billing and Administration

A major driver of high healthcare costs in the US is the immense administrative overhead associated with the current multi-payer system. Private insurance companies incur significant expenses in marketing, underwriting, claims processing, and managing complex networks. In contrast, Medicare, as a single-payer system, operates with a much leaner administrative structure. Overhead costs in private insurance are estimated to be around 12.4% of spending, compared to just 2.2% for Medicare. By consolidating insurance into a single-payer framework under MAA, significant administrative savings can be achieved. This includes eliminating redundant corporate structures, streamlining billing processes, and reducing the vast paperwork burden on healthcare providers. Projections suggest that consolidating insurance administration to Medicare’s efficiency level could save hundreds of billions of dollars annually. Furthermore, a unified system can enhance fraud detection. With a comprehensive database of healthcare claims, irregularities and fraudulent activities become easier to identify and address, leading to further cost savings. While the exact amount of fraud reduction is subject to estimation, even conservative projections suggest substantial potential savings in this area.

Negotiating Power: Pharmaceutical Price Controls

Prescription drug costs in the US are significantly higher than in any other developed nation. This is largely due to the lack of government negotiation power and legislative restrictions that prevent Medicare from negotiating drug prices. Pharmaceutical companies in the US operate with minimal price regulation, leading to inflated prices for both brand-name and generic medications. MAA proposes to empower the Department of Health and Human Services to negotiate drug prices on behalf of the entire US population, leveraging the purchasing power of a single-payer system. A potential model for this is the US Department of Veterans Affairs (VA), which already negotiates drug prices and achieves significantly lower costs compared to Medicare. By implementing similar negotiation authority nationwide, MAA aims to drastically reduce pharmaceutical expenditure. Projections based on VA pricing models suggest potential savings of hundreds of billions of dollars annually through pharmaceutical price negotiation. While concerns about the impact of price reductions on pharmaceutical innovation exist, the current system’s high prices do not demonstrably translate into proportionally higher innovation rates. Moreover, the interactive SHIFT tool mentioned in the original research allows for varying levels of pharmaceutical price reduction to assess the overall impact on healthcare costs, demonstrating that even without maximum price reductions, MAA can still lead to net savings.

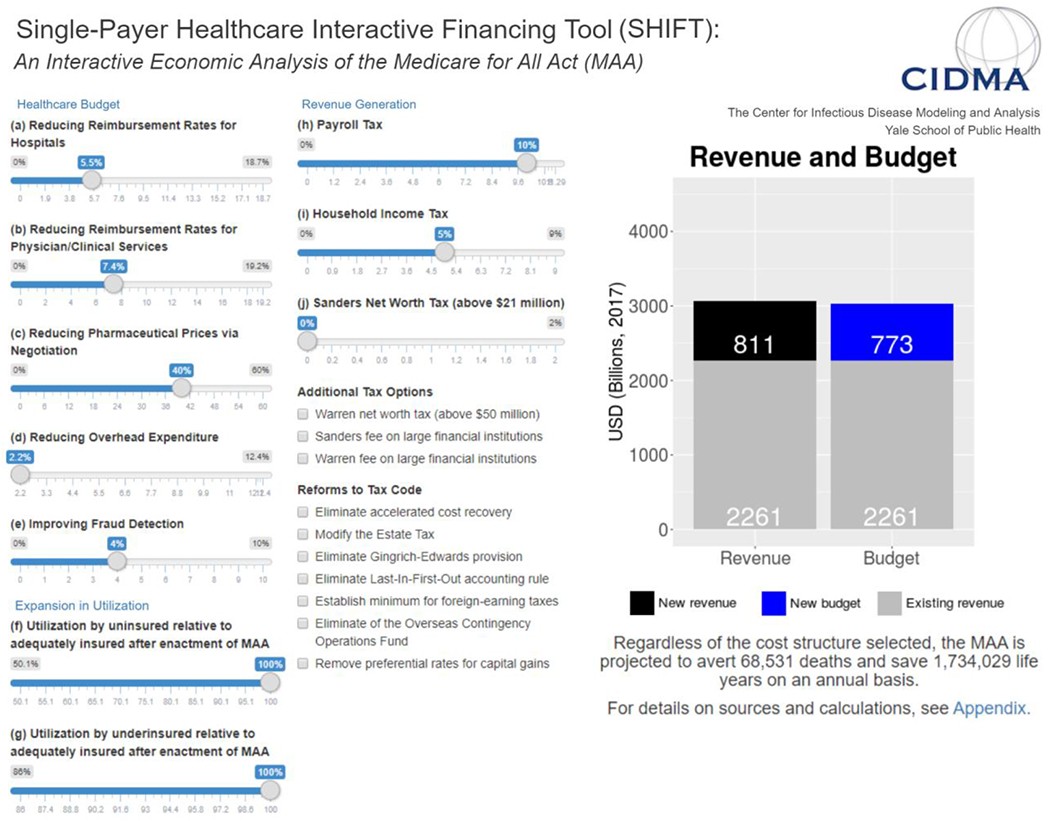

Figure 1. Single-Payer Healthcare Interactive Financing Tool (SHIFT) interface (http://shift.cidma.us/).

Alt Text: Screenshot of the Single-Payer Healthcare Interactive Financing Tool (SHIFT) website interface, showing adjustable parameters for healthcare budget, expansion in utilization, and revenue generation.

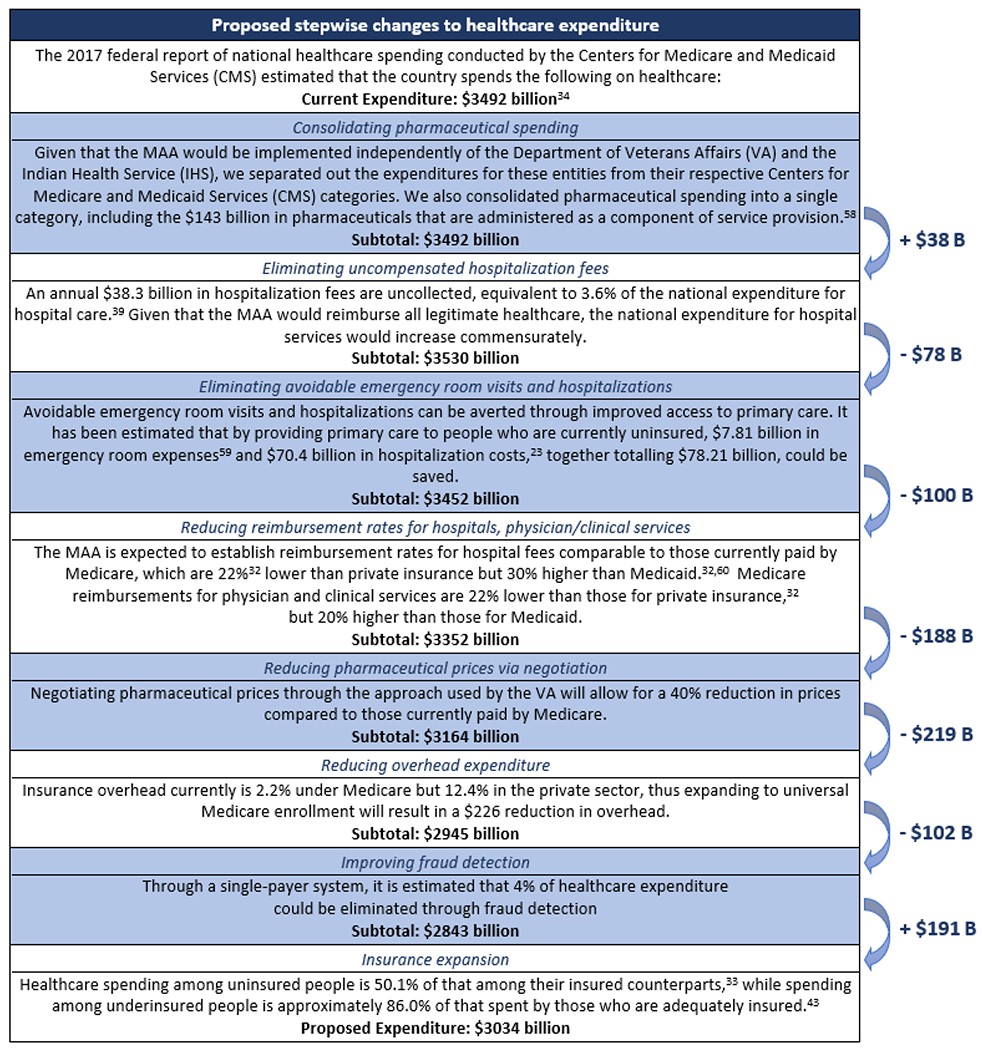

Figure 2. Influence of key parameters on national healthcare expenditure.

Alt Text: Graph illustrating the impact of varying key parameters like physician fees, hospital fees, fraud reduction, overhead, pharmaceutical prices, and healthcare utilization on the total national healthcare expenditure budget under a single-payer system.

Accounting for Increased Coverage: Utilization and Preventative Care

While MAA aims to reduce costs through efficiency and negotiation, it also entails expanding coverage to all Americans, including the currently uninsured and underinsured. This universal coverage will naturally lead to increased utilization of healthcare services, as those who previously lacked access or faced financial barriers will now be able to seek necessary medical attention. It is crucial to consider this increased utilization when calculating the overall cost of universal healthcare. However, it’s important to recognize that increased utilization, particularly in preventative care, can lead to long-term cost savings and improved health outcomes. Preventative care measures, such as regular check-ups, screenings, and vaccinations, can help detect and manage health issues early, preventing more serious and costly conditions from developing later. Furthermore, providing consistent care for chronic conditions can reduce emergency room visits and hospitalizations, further contributing to cost savings in the long run. Therefore, while universal coverage will increase initial utilization, it is also an investment in preventative health, potentially mitigating future healthcare costs and improving overall public health.

The Net Financial Impact: Savings Outweighing Costs

Considering both the cost savings from efficiency measures and the increased costs from coverage expansion, analyses of MAA project a net reduction in national healthcare expenditure. The original research estimates that a single-payer system could reduce national healthcare spending by approximately 13%, equivalent to over $450 billion annually. This projection takes into account savings from reduced fees, administrative overhead, pharmaceutical prices, and fraud reduction, while also factoring in the increased utilization from newly insured individuals. The interactive SHIFT tool further demonstrates that these net savings are robust across a range of assumptions and parameter variations. This suggests that how much will universal health care cost under MAA is not just about the gross expenditure, but about the net financial impact, which is projected to be significantly lower than the current system’s costs. The key takeaway is that universal healthcare, when implemented through a single-payer system like MAA, is not necessarily a more expensive proposition, but rather a potentially more efficient and cost-effective approach to healthcare financing.

Figure 3: Overview of Single-Payer Healthcare Interactive Financing Tool Calculations.

Alt Text: Flow chart illustrating the calculation overview of the Single-Payer Healthcare Interactive Financing Tool, showing how different cost-saving measures like reduced hospital fees, clinical fees, overhead, and drug prices contribute to net national healthcare expenditure reduction under MAA.

Funding Universal Healthcare: Restructuring Expenditure

The funding for universal healthcare under MAA is proposed to be primarily through a restructuring of existing healthcare payments. Currently, employers and households contribute significantly to healthcare costs through insurance premiums and out-of-pocket spending. MAA proposes to replace these premiums with public funding mechanisms, such as payroll taxes for employers and income taxes for households. The analysis suggests that setting payroll and income tax rates at levels lower than current premium expenditures can generate sufficient revenue to fund the MAA while simultaneously resulting in savings for both employers and households. For example, a payroll tax rate lower than the current average employer premium contribution would still generate substantial public funding, relieving businesses of their healthcare benefit burdens and potentially stimulating economic growth. Similarly, a progressive income tax structure, where higher earners contribute a larger percentage, can ensure sufficient funding while providing financial relief to lower and middle-income households who currently struggle with high premiums and out-of-pocket costs. This shift from premiums to taxes represents a redistribution of healthcare financing, moving away from a system where access is tied to employment and ability to pay, towards a system where healthcare is a publicly funded right for all.

Table 1:

Employer and household expenditures on healthcare premiums compared with proposed payroll and household taxes, respectively. These expenditures and tax rates derive from Sanders et al. and the Centers for Medicare and Medicaid Services (CMS),28,40 as are detailed in the Appendix. For households, the tax rate is applied to income above $29,000, as stipulated in Sanders et al.28,40

| Employer Premiums, National Total | Household Premiums and Out-of-Pocket Spending, Average |

|---|---|

| Current | Proposed |

| Annual expenditure | $536 billion |

| Equivalent tax rate | 11.29% |

Alt Text: Table comparing current employer and household healthcare premium expenditures with proposed payroll and household tax rates under MAA, showing potential savings in annual expenditure and equivalent tax rates.

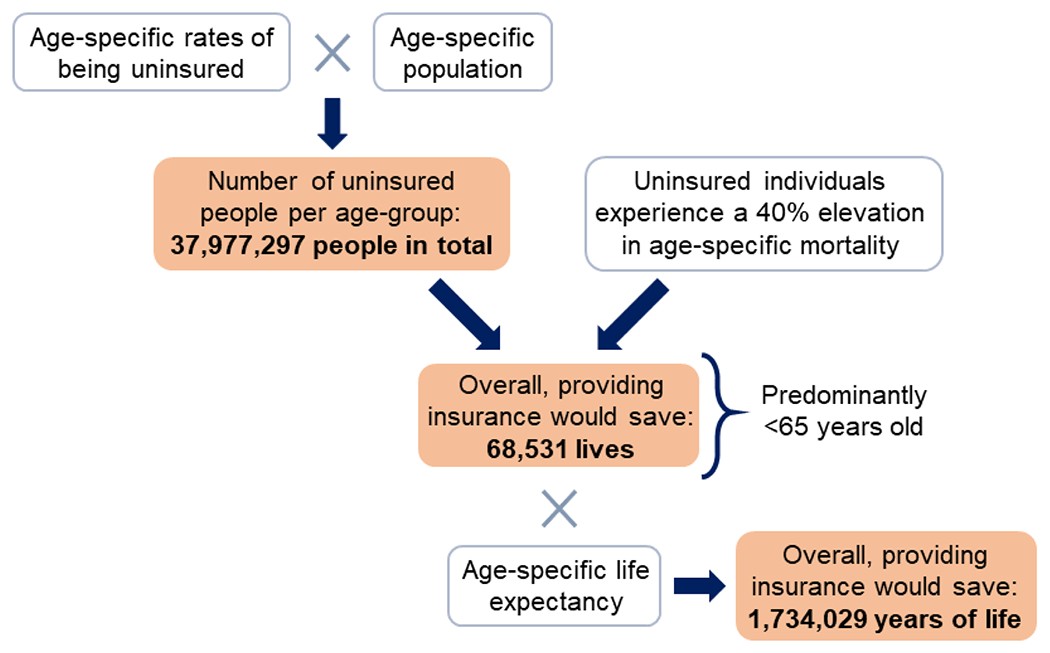

Beyond Cost: The Value of Lives Saved and Healthier Population

While the financial aspects of universal healthcare are critical, it’s essential to consider the broader benefits beyond just cost savings. Universal healthcare, by ensuring access for all, has the potential to save thousands of lives annually. Studies indicate that uninsured individuals face a significantly higher mortality risk compared to those with insurance. By providing coverage to the currently uninsured, MAA is projected to save tens of thousands of lives each year and prevent millions of life-years lost due to premature mortality. Furthermore, universal healthcare can lead to a healthier and more productive population. Improved access to preventative and primary care can reduce the incidence of chronic diseases, improve management of existing conditions, and enhance overall well-being. A healthier workforce translates to increased productivity, reduced absenteeism, and a stronger economy. Therefore, when evaluating how much will universal health care cost, it’s crucial to consider not just the financial bottom line, but also the immeasurable value of lives saved, improved health outcomes, and a more equitable society.

Figure 4:

Alt Text: Bar graph illustrating the life-saving potential of Medicare for All compared to the present healthcare system, highlighting the number of lives saved and life-years gained annually through universal coverage.

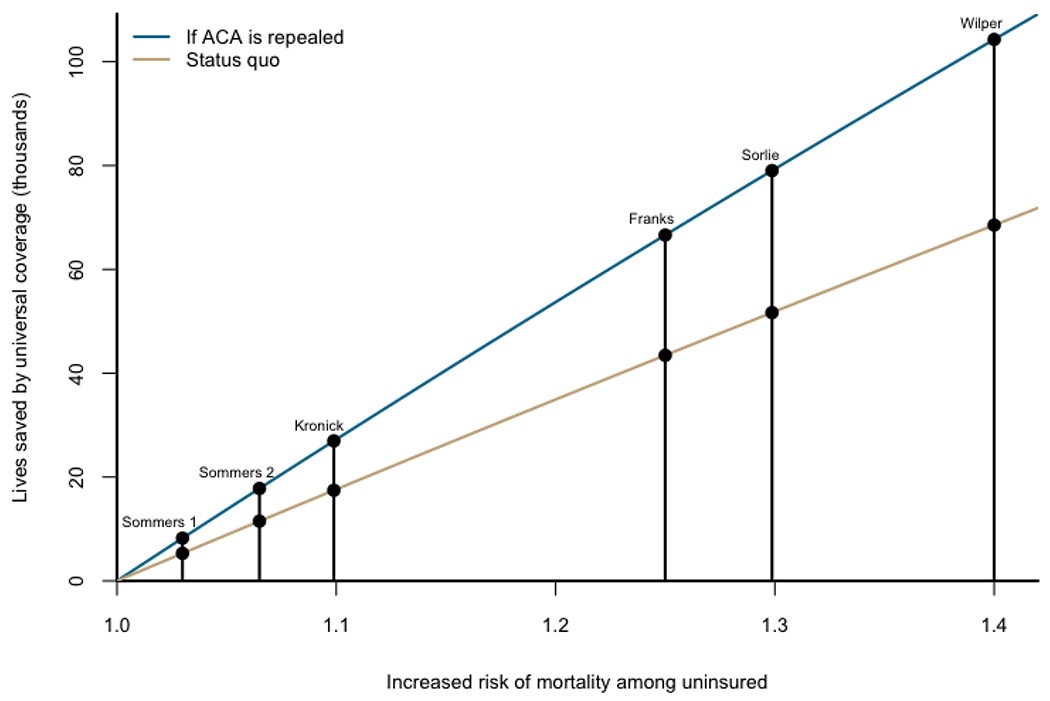

Figure 5:

Alt Text: Line graph depicting the number of lives saved by Medicare for All as a function of increased mortality risk among the uninsured, showing lives saved under both current status quo and if the Affordable Care Act is repealed.

Conclusion: Investing in Health, Saving on Costs

In conclusion, the question of how much will universal health care cost is not simply about the initial expenditure, but about the net financial impact and the broader societal benefits. Projections for a single-payer universal healthcare system like the Medicare for All Act indicate that it is not only financially feasible but also has the potential to generate significant cost savings compared to the current US healthcare system. These savings are driven by reduced administrative overhead, lower service fees, negotiated pharmaceutical prices, and fraud reduction. While universal coverage entails increased utilization of healthcare services, this is offset by the long-term benefits of preventative care and a healthier population. Furthermore, universal healthcare promises to save thousands of lives annually and improve the overall well-being and productivity of Americans. Therefore, shifting towards a universal healthcare system is not just a matter of social equity and improved health outcomes, but also a potentially sound economic strategy that can lead to a more efficient and cost-effective healthcare system for the nation.

Supplementary Material

Appendix

NIHMS1749299-supplement-Appendix.pdf (212.3KB, pdf)

Panel 1:

Parameter defaults and bounds for the Single-Payer Healthcare Interactive Financing Tool (SHIFT)

Healthcare Budget

(a) Reducing reimbursement rates for hospitals.

If all hospital fees were reimbursed at current Medicare rates, the fees would overall be 5.54% lower (default) overall, and if reimbursed at Medicaid rates, fees would be reduced by 18.74% (upper bound).

(b) Reducing reimbursement rates for physician/clinical services.

If all physician and clinical services were reimbursed at current Medicare rates, the fees would overall be 7.38% lower (default), and if reimbursed at Medicaid rates, fees would be reduced by 19.23% (upper bound).

(c) Reducing pharmaceutical prices via negotiation.

The VA has the authority to negotiate prices in accordance with therapeutic value, achieving prices that are 40% lower than those paid by Medicare25 (default).

(d) Reducing overhead expenditure.

Within the US system currently, insurance overhead ranges from 2.2% for Medicare (lower bound, default) to 12.4% for the private sector26 (upper bound).

(e) Improving fraud detection.

Given estimates that 4% of healthcare expenditure (default) could be eliminated through fraud detection within the first two years of implementing a single-payer system,27 we allow fraud reduction to range from 0% (lower bound) to 10% (upper bound) upon enactment of the MAA.

Expansion in Utilization

(f), (g) Utilization of the uninsured and underinsured relative to the adequately insured after enactment of the MAA.

We allow expected healthcare utilization by un- and under-insured Americans to range from current levels (lower bound) to usage commensurate with those who are fully insured (default, upper bound).

Revenue Generation

(h) Payroll tax.

The $536 billion currently spent by employers on healthcare premiums is equivalent to a 11.29% payroll tax (upper bound). Any payroll tax that collects revenue below the current expenditure would represent savings, including our default value of 10%.

(i) Household income tax.

Households currently pay $738 billion towards premiums and out of pocket expenditures. Only $64 billion in out-of-pocket costs would remain under MAA. If the remaining $674 billion in spending were replaced by a 5% household income tax (default) on income beyond the standard deduction, the tax would yield $375 billion annually.28 The $674 billion replaced by MAA would be equivalent to a tax rate of 9% (upper bound).

(j) Sanders net worth tax, above $21 million.

A 1% tax on household net worth above $21 million, applied to 0.1% of all households, would yield $109 billion annually.28 This tax rate can be modified by the user to range from 0% (lower bound, default) to 2% (upper bound).

See Appendix for additional details on input parameters and assumptions.

Funding Source:

A.P.G. is supported by the Burnett and Stender Families’ Endowment. A.S.P is supported by the Yale Climate Change and Health Initiative through a grant from the Overlook International Foundation. M.C.F is supported by the National Institutes of Health grant K01 AI141576 and the Notsew Orm Sands Foundation.

References:

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix

NIHMS1749299-supplement-Appendix.pdf (212.3KB, pdf)