Accidents are stressful, and dealing with the aftermath, especially vehicle damage, can be overwhelming. One of the biggest questions after a significant car accident is, “Is my car totaled?” It’s not always obvious just by looking at the damage. While dents and broken glass are clear indicators of impact, determining if your car is a total loss involves a deeper assessment of repair costs versus the vehicle’s actual worth. Understanding how insurance companies make this determination is crucial for navigating the claims process and ensuring you receive fair compensation. This guide will walk you through the process of figuring out if your car is totaled, empowering you with the knowledge to understand your situation and make informed decisions.

Understanding “Totaled Car” or “Total Loss”

In the simplest terms, a car is considered “totaled” or a “total loss” when the cost to repair the damage exceeds the vehicle’s value. This doesn’t necessarily mean your car is crushed beyond recognition. Even with seemingly repairable damage, the financial calculation can lead to a total loss declaration. Insurance companies use this concept to decide whether to repair your vehicle or declare it a total loss and provide you with compensation for its pre-accident value.

The Formula: Repair Cost vs. Actual Cash Value (ACV)

The core of the “totaled” determination lies in comparing two key figures: the cost of repair and the Actual Cash Value (ACV) of your vehicle. If the repair cost is higher than the ACV, your car is likely to be declared a total loss.

What is Actual Cash Value (ACV)?

Actual Cash Value (ACV) is essentially the market value of your car immediately before the accident. It represents what your car was worth if you had decided to sell it right before the damage occurred. ACV takes into account factors like your car’s:

- Age: Older cars generally have lower ACVs due to depreciation.

- Mileage: Higher mileage usually reduces a car’s value.

- Condition: The overall condition of your car, including wear and tear, both cosmetic and mechanical, affects its ACV.

- Features and Upgrades: Optional features and aftermarket upgrades can sometimes increase the ACV.

- Market Demand: The popularity and demand for your car’s make and model in your local market can also play a role.

Insurance companies use various methods to determine ACV, often relying on third-party valuation services like Kelley Blue Book, NADA Guides, or by comparing prices of similar vehicles in your area. It’s important to understand that ACV is not the price you originally paid for the car, nor is it the cost of a brand new vehicle. It’s the depreciated value of your car at the time of the accident.

What is Repair Cost?

The repair cost is the estimated expense to restore your damaged vehicle to its pre-accident condition. This estimate should come from a reputable auto body shop and should include:

- Parts: The cost of all necessary replacement parts, including both new and potentially used or aftermarket parts.

- Labor: The cost of labor for mechanics and bodywork technicians to perform the repairs.

- Painting and Refinishing: Costs associated with repainting damaged areas to match the original finish.

- Taxes and Fees: Any applicable taxes and fees associated with parts and labor.

It’s crucial to get detailed and itemized repair estimates. Insurance companies will often send their own appraisers to assess the damage and generate their repair estimates. You have the right to get your own independent estimates to compare.

Salvage Value: A Factor in the Insurance Process

While not directly used in the initial “totaled” determination (repair cost vs. ACV), salvage value becomes relevant once a car is declared a total loss. Salvage value is the estimated worth of your vehicle in its damaged state. This is the value that can be recovered by selling the car for scrap metal, usable parts, or to a salvage yard.

Insurance companies often retain the salvage rights to totaled vehicles. They will subtract the salvage value from the ACV when calculating your settlement offer. In some cases, you may have the option to keep your totaled vehicle, but the salvage value will be deducted from your payout, and the vehicle will typically receive a salvage title, which can impact its future resale value and insurability.

Factors That Influence a Total Loss Determination

Beyond the core formula of repair cost vs. ACV, several factors can influence whether your car is declared a total loss:

Vehicle’s Age and Mileage

Older vehicles with high mileage generally have lower ACVs. Therefore, even moderate damage to an older car might easily exceed its ACV, leading to a total loss declaration. Conversely, newer cars with lower mileage typically have higher ACVs, making it less likely for damage to surpass their value unless the damage is very severe.

Vehicle Condition

A car in poor condition before the accident, with pre-existing damage or mechanical issues, will have a lower ACV. This makes it more susceptible to being totaled, as the repair costs from a new accident, combined with the vehicle’s already diminished value, can quickly exceed its ACV.

Upgrades and Features

While upgrades and features can increase ACV, they may not always be fully accounted for by insurance companies. It’s important to document any significant upgrades or features your car has to ensure they are considered when determining ACV.

The Total Loss Threshold: Not a Fixed Number

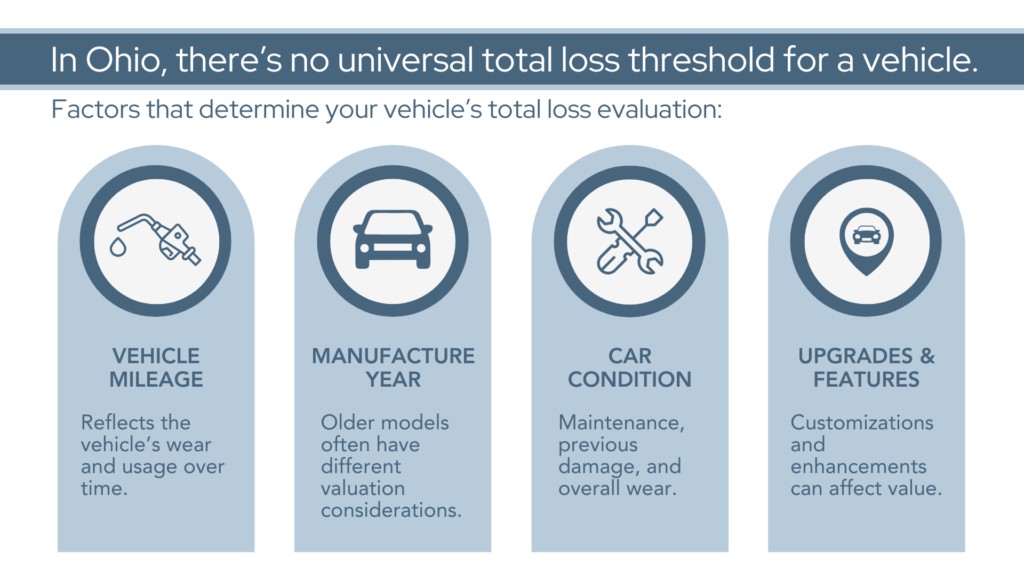

Many states have what’s called a “total loss threshold,” which is a percentage of the vehicle’s value. However, it’s important to understand that not all states use a fixed percentage threshold. Some states, like Ohio, operate under what’s known as a “total loss formula.” This means there isn’t a specific percentage or dollar amount that automatically triggers a total loss declaration. Instead, the insurance company will use the repair cost vs. ACV calculation described earlier.

This means that the total loss threshold is effectively unique to each vehicle and situation. It depends on the specific ACV of your car and the estimated repair costs.

car totaled after accident

car totaled after accident

What Happens When Your Car is Totaled?

If your insurance company determines your car is a total loss, they will typically take one of two approaches:

Cash Settlement vs. Replacement

- Cash Settlement: The most common option is for the insurance company to offer you a cash settlement. This is a payment equal to the ACV of your car, minus your deductible and potentially the salvage value if you keep the vehicle.

- Replacement: In some cases, and depending on your policy and state laws, the insurance company may offer to replace your vehicle with a comparable one. This means they find a vehicle of similar make, model, year, mileage, condition, and features. However, cash settlements are generally more common.

How Insurance Calculates Total Loss Value

When calculating the cash settlement for a total loss, insurance companies generally follow these steps:

- Determine the ACV: They will assess your car’s Actual Cash Value using methods like market comparisons or valuation services.

- Calculate the Deductible: Your policy deductible will be subtracted from the ACV.

- Subtract Salvage Value (if applicable): If you choose to keep your totaled vehicle, the estimated salvage value will be deducted from the settlement.

The final amount offered should represent the fair market value of your car just before the accident, minus your deductible and any salvage value deduction.

Deductibles and Totaled Cars

Yes, unfortunately, even when your car is totaled, your deductible still applies. Whether you receive a cash settlement or a replacement vehicle, your deductible will be subtracted from the settlement amount or factored into the overall cost.

Insurance Payout – What to Expect

The insurance payout for a totaled car is designed to compensate you for the financial loss of your vehicle, up to its ACV. It’s not intended to provide you with enough money to buy a brand new car of a different make or model. It’s meant to put you back in the financial position you were in immediately before the accident, in terms of vehicle value. It’s also important to remember that if you owe more on your car loan than the ACV, the insurance payout may not fully cover your loan balance. This is where “gap insurance” can be beneficial, as it covers the “gap” between the ACV and the outstanding loan amount.

Steps to Take If You Suspect Your Car is Totaled

If you suspect your car might be totaled after an accident, here are important steps to take:

- Get Multiple Repair Estimates: Obtain detailed repair estimates from at least two reputable auto body shops. This will give you a clear picture of the potential repair costs.

- Research the ACV of Your Car: Use online resources like Kelley Blue Book or NADA Guides to get an estimate of your car’s Actual Cash Value based on its year, make, model, mileage, condition, and features.

- Communicate with Your Insurance Company: Report the accident to your insurance company promptly and cooperate with their claims process. Ask them about their process for determining if a car is totaled and how they calculate ACV and repair costs.

- Compare Repair Costs to ACV: Compare the repair estimates you received to the estimated ACV of your car. If the repair costs are approaching or exceed the ACV, your car is likely to be totaled.

- Negotiate (if necessary): If you disagree with the insurance company’s assessment of ACV or repair costs, you have the right to negotiate and provide supporting documentation, such as your own independent appraisals or comparable vehicle listings.

When to Consider Legal Help

Dealing with a totaled car and insurance claims can be complex and frustrating. You might consider seeking legal assistance from an attorney experienced in car accident claims if:

- You disagree with the insurance company’s determination that your car is not totaled when you believe it should be.

- You feel the insurance company is undervaluing your car’s ACV.

- You are having difficulty negotiating a fair settlement with the insurance company.

- The accident involved complex circumstances, injuries, or disputes about fault.

An attorney can advocate for your rights, help you understand your policy, negotiate with the insurance company on your behalf, and ensure you receive a fair settlement for your totaled vehicle.

Conclusion

Determining if your car is totaled is a crucial step after a significant accident. By understanding the core concept of repair cost versus Actual Cash Value, and by taking proactive steps to gather information and communicate effectively with your insurance company, you can navigate the process with greater confidence. Remember to get independent repair estimates, research your car’s ACV, and don’t hesitate to seek professional help if you encounter difficulties or believe you are not being treated fairly. Knowing your rights and understanding the process empowers you to achieve the best possible outcome after a car accident.