If you’re just starting to explore career options, you might be wondering, “Is Finance A Good Career Path?”. Searching online often yields superficial answers, focusing on obvious perks like “high salaries.” But a truly insightful answer needs to consider the long-term trajectory of the finance industry. A “good career path” isn’t just about today’s benefits; it’s about the industry’s vitality and opportunities over the next decade or two, as your career progresses.

While finance careers have been highly sought-after from 1980 to 2020, the crucial question is: will this desirability persist through 2040 and beyond? Let’s delve into the factors that will shape the future of finance careers and determine if it remains a promising path.

Defining Finance and a “Good Career”

The term “finance” encompasses a vast spectrum of roles. From corporate finance positions within regular companies to specialized areas like credit analysis, commercial banking, private wealth management, investment banking, private equity, hedge funds, venture capital, commercial real estate, and risk management, the options are diverse. For the purpose of this analysis, we’ll primarily focus on roles centered around advising companies on significant transactions or investing in businesses – specifically investment banking (IB), private equity (PE), hedge funds (HFs), and venture capital (VC). These areas are often at the forefront of the finance industry and are key interests for many aspiring finance professionals.

Defining a “good career” is more subjective, but we can establish some objective criteria. A good career is one where the advantages substantially outweigh the disadvantages, and this favorable balance is projected to continue for the foreseeable future, say, the next 10 to 20 years.

The “benefits” of a finance career are often cited as high compensation, attractive exit opportunities, valuable networking potential, the development of a robust skill set, and the intellectually stimulating nature of the work itself. Conversely, the “costs” involve the intense competition and considerable effort required to break into and advance within these careers.

Historically, finance careers have been perceived as high-cost, high-reward endeavors. Securing an entry-level position is notoriously challenging, but the promise of substantial compensation and lucrative exit opportunities has traditionally justified the initial struggle. Advancement is also demanding, but the exponential growth in earnings as you climb the ranks has typically been seen as a worthwhile trade-off. Top performers can achieve annual incomes of $1 million or more, and even those who plateau or face setbacks can still earn comfortably in the mid-six-figure range and beyond. While these figures are generally lower outside the U.S., finance professionals worldwide often earn multiples of their country’s median household income.

But the critical question remains: will this paradigm endure? Is finance still a good career path in the long run? To answer this, we need to examine both the costs and benefits and consider how they are evolving.

The “Costs” of a Finance Career: Recruitment and Advancement in the Modern Era

Looking at the “cost” side, it’s debatable whether recruiting for finance roles has become inherently “more difficult.” However, the process has undoubtedly become more complex and prone to missteps. Several factors contribute to this:

- Accelerated Recruitment Timelines: The recruitment cycle, particularly for summer internships in the U.S. and on-cycle private equity recruiting for those already in banking, has moved significantly earlier. This compressed timeline demands earlier preparation and application submission from candidates.

- Sequential Internship/Job Requirements: Breaking into finance increasingly requires a structured progression of internships and roles. This sequential nature can disadvantage students who discover finance later in their academic careers or professionals seeking a career change.

- Increased Automation in Screening: The rise of automated tools like HireVue interviews and online assessments has transformed the initial screening stages. Recruiters are also leveraging technology to filter candidates, adding another layer of complexity to the application process.

While there’s a perception that interviews have become excessively “technical,” this might be slightly exaggerated. Anecdotal evidence suggests that despite the abundance of online resources and preparation materials, the fundamental technical skills of candidates might not be improving as drastically as perceived. A senior banker involved in recruitment at a major bank recently noted that candidates’ technical abilities have, in some cases, deteriorated. The emphasis has shifted from rote memorization to a deeper understanding of core financial concepts. While advanced technical expertise isn’t necessarily mandatory at the entry level, a solid grasp of the fundamentals is crucial. Relying solely on outdated study guides is no longer sufficient; thorough preparation is essential.

Advancement within finance presents a mixed picture. Moving from the Analyst level to mid-level positions within banks may have become somewhat smoother. However, transitioning to highly coveted buy-side roles, such as private equity, has become more competitive and less predictable. Considering all factors, while recruitment and advancement haven’t drastically worsened, they might be perceived as less favorable, particularly for candidates from non-traditional backgrounds. The finance industry, known for its traditional practices, may not undergo rapid changes in these areas in the coming years. Interestingly, with the advancement of AI, there’s even a possibility that recruitment could become less automated, with a renewed emphasis on in-person evaluations to mitigate the limitations of remote testing.

The more compelling aspects of the “Is Finance a Good Career Path?” question lie in the “benefits” side of the equation. Specifically, will the high compensation and attractive exit opportunities that have long been hallmarks of finance careers continue to be as robust in the future?

The Golden Age: The Finance Career Path from 1980 to 2020

Finance jobs have historically offered higher compensation compared to roles in other sectors. However, this “finance wage premium” was considerably smaller in the period spanning from 1930 to 1970. Data indicates a dramatic shift:

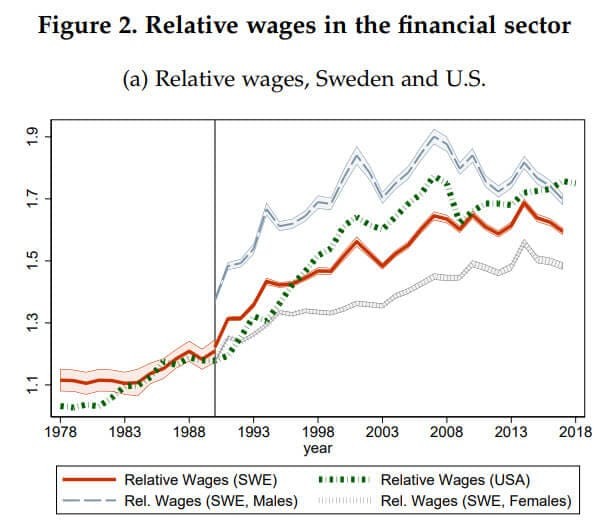

Chart showing the finance wage premium in the US from 1978 to 2018, illustrating a significant increase over time.

While this data encompasses the broader “financial sector,” including diverse roles, it reveals a significant trend. In the U.S., the average pay premium in finance surged from approximately 5-10% in 1978 to over 70% by 2018. For more specialized areas like investment banking, this increase could be even more pronounced, potentially ranging from 50% to 200%.

Before the 1980s, while finance careers were still appealing, the intense competition for entry-level positions was less pronounced than it is today. The landscape began to transform in the 1980s, and by the decade’s end, a noticeable shift occurred among top university students, with a growing interest in finance. This trend gained momentum through the 1990s and 2000s, weathering the 2008 financial crisis and persisting into the early 2020s.

Several major macroeconomic trends fueled this remarkable rise of finance:

- Declining Interest Rates: Falling interest rates have a stimulative effect on asset prices across the board, including stocks, bonds, and real estate. Lower interest rates also make deal-making more attractive as the cost of capital decreases. The dramatic decline in interest rates over this period is visually striking.

-

Deregulation and Antitrust Decline: Reduced regulation and less stringent antitrust enforcement facilitated larger mergers and acquisitions. This environment translated to higher fees for investment banks, expanded exit opportunities for investors, and increased demand for entry-level finance professionals to support deal activity.

-

Emerging Market Growth: The rapid economic expansion of countries like China, transforming them into global manufacturing hubs, led to increased outsourcing from Western nations. This trend favored the managerial and professional classes in developed economies, with finance being a prime beneficiary.

-

Favorable Demographic Trends: Global population growth from 4.4 billion in 1980 to 7.9 billion in 2020 expanded consumer markets, corporate growth opportunities, and overall market size. While some developed nations experienced aging populations, large emerging markets like India maintained a youthful demographic profile, contributing to global economic dynamism.

-

Technology and Automation (Initially Limited Impact on White-Collar Jobs): Automation during this era primarily impacted manufacturing and blue-collar jobs, largely sparing white-collar professions. The technological tools available at the time were not sophisticated enough to significantly “replace” or displace office workers, including those in finance.

-

Low and Stable Inflation and Energy Prices: Following the inflationary pressures of the 1970s, inflation subsided and remained relatively low and stable for several decades, at least until 2021. This stability, coupled with relatively cheap energy, provided businesses with greater predictability and fueled significant economic growth.

While bankers from today transported back to 1970 would still earn a respectable income, their pay premium relative to the median household income would be lower. This is because the full impact of these favorable macroeconomic trends had yet to materialize.

Headwinds Ahead: A Less Favorable Macro Environment for Finance

Looking ahead to the coming decades, many of the macroeconomic factors that propelled the finance industry’s growth from 1980 to 2020 are poised to reverse or diminish, potentially leading to a contraction in the “finance wage premium.”

Interest rates, while currently higher than the lows of the 2010s, remain historically low. The possibility of another dramatic decline from double-digit levels to near-zero is highly unlikely. In fact, the trend may be towards a higher interest rate environment compared to the previous decades.

Regulation and antitrust scrutiny are gaining renewed prominence in both Europe and the U.S. Increased regulatory oversight and a more assertive antitrust stance, as exemplified by the FTC’s actions towards Big Tech and large mergers, could constrain deal activity and profitability in certain finance sectors.

Demographic trends are shifting towards a less favorable landscape. China’s population is now declining for the first time in decades, and many developed countries are grappling with record-low birth rates. While Africa’s population continues to grow, it’s unlikely to fully offset the demographic headwinds in other regions.

Automation has reached a level of sophistication where it can now potentially impact white-collar jobs, including those in finance. Even if automation doesn’t entirely eliminate jobs, it could significantly slow future job growth and alter the skillsets required in the industry.

Energy prices and inflation are expected to be more volatile in the future. The push towards ESG (Environmental, Social, and Governance) investing and the increasing costs associated with extracting traditional fossil fuels are contributing to this volatility. Furthermore, the growing demand for minerals essential for the “energy transition” could lead to geopolitical instability and resource competition in mineral-rich regions.

Collectively, these factors point towards reduced business visibility, lower global growth potential, and increased challenges in investing and executing deals. It’s important to note that these headwinds are not unique to finance. The technology sector, which benefited equally from the favorable conditions of 1980-2020, will also face similar challenges in this evolving macroeconomic landscape.

Counterarguments and Potential Upsides

One might argue that central banks will eventually lower interest rates again, that regulatory pressures might ease, and that inflation will eventually return to target levels. It’s also conceivable that the progress of automation and AI tools could be hampered by unforeseen legal or technological obstacles. While these scenarios are possible, some trends appear less likely to reverse in the near term.

For instance, demographic shifts in China and Western nations are deeply entrenched and won’t change overnight. Even if birth rates were to rebound, the demographic impact would take a generation or more to materialize. Similarly, even if a technological breakthrough were to drastically reduce energy costs and enhance reliability, the widespread adoption and impact of such a breakthrough would likely take decades.

The overarching conclusion is not that the finance industry is destined for collapse. However, a return to the exceptional growth trajectory of the 1980-2020 period seems improbable in the next 10-20 years. The industry may perform better than anticipated, but expecting a repeat of its past expansion may be overly optimistic.

Predictions: The Finance Career Path from 2020 to 2040

Based on these macroeconomic considerations, here are some potential predictions for the finance career path in the coming decades:

- A Moderated Finance Wage Premium: The finance wage premium is likely to persist, but it could moderate to around the 40-50% range. While still attractive, it would be lower than the peak levels observed in recent decades but still higher than the historical norms of the mid-20th century.

- Increased Cyclicality: The finance job market, deal flow, and bonus structures will likely become more cyclical and volatile, mirroring the fluctuations observed during periods like 2020-2022. These cycles could become more frequent and pronounced.

- Shift Towards Smaller Deals: Large-scale deals (over $1 billion) may face increased regulatory scrutiny and be more frequently blocked, delayed, or modified. The focus might shift towards smaller deals and asset-level acquisitions.

- Automation as a Growth Limiter: Automation will likely act as a constraint on job growth in finance. However, client-facing roles in areas like investment banking and private equity might be relatively insulated due to the importance of human interaction and judgment.

- Real Asset Outperformance: Real assets, such as real estate, infrastructure, and commodities, could potentially outperform financial assets like stocks and bonds, especially in inflationary environments.

- Opportunities in Real Asset and Volatility-Focused Firms: Firms specializing in investing in or advising real asset companies, as well as hedge funds employing strategies focused on volatility, global macro trends, or special situations, may find themselves well-positioned in this evolving landscape.

- Enduring Exit Opportunities: Despite potential shifts in compensation, the valuable exit opportunities associated with finance careers are likely to remain a significant draw, continuing to surpass those available in many other sectors.

So, Is Finance Still a Good Career Path for You?

The concise answer is: Yes, finance remains a good career path, but it may not be as comparatively advantageous as it has been in recent decades.

For highly qualified individuals from top universities and business schools who start early in their finance journey, it’s still a viable and rewarding option. Even if the industry’s future trajectory differs from past expectations, the skills acquired in finance are highly transferable and can open doors to diverse career paths.

However, for non-traditional candidates, it might be prudent to reconsider placing all emphasis on highly competitive areas like IB, PE, HF, and VC. The costs associated with breaking into these fields may not be fully justified by the potential benefits, especially if recruitment efforts are started later in the cycle.

While identifying a definitively “better” alternative is challenging, exploring related “side door” and “back door” options within finance, such as commercial real estate, corporate banking, or corporate finance, could be strategically advantageous for non-traditional candidates. Ultimately, the goal remains achieving financial independence through high income generation, whether through employment, entrepreneurship, or side ventures.

The recommended approach remains consistent: pursue 1-2 finance internships early in your university years to gain firsthand experience and assess your fit within the industry. If finance aligns with your interests and skills, continue on that path. If not, explore alternative options. Focus on developing automation-resistant skills, particularly in areas requiring human interaction and salesmanship. Within a few years, evaluate whether you are progressing on a desired career trajectory or if pursuing a side project, business, or alternative income stream is more compelling.

The key difference in today’s environment is the heightened importance of diversification. The finance career path is likely to become less predictable, with wider compensation ranges and greater year-to-year fluctuations. Relying solely on a single income source in a more volatile economic climate carries increased risk. Therefore, starting early in your 20s to build a strong financial foundation is crucial. This proactive approach ensures that by your 30s, 40s, and beyond, you possess the financial security and flexibility to navigate career transitions, take breaks, or pursue different paths without feeling constrained. Fortunately, finance still offers a solid foundation for building that financial “nest egg”.

Further Reading

You might be interested in:

Investment Banking Industry Outlook