Tesla Car Insurance is a hot topic for electric vehicle owners. As your trusted source for automotive insights, CARS.EDU.VN helps you navigate the complexities of insuring your Tesla, comparing manufacturer-provided coverage with third-party options to find the best fit. Learn about coverage options, affordability, and what other Tesla drivers are saying. Explore the world of electric vehicle protection and make informed decisions.

1. Deciphering Tesla Car Insurance Costs

Insuring a Tesla can be pricier than insuring a standard vehicle. The average annual cost for full coverage on a 2021 Tesla model is approximately $4,098, or $352 monthly. This represents a 72% increase compared to the average cost for a conventional car with full coverage. However, costs can vary significantly based on the specific Tesla model.

| Tesla Model | Average Annual Cost | Average Monthly Cost |

|---|---|---|

| Model 3 (2021) | $3,664 | $305 |

| Model Y (2021) | $3,426 | $286 |

These figures include state-required minimum liability insurance in addition to comprehensive and collision coverage, key components of a full coverage policy. CARS.EDU.VN can provide tailored insurance estimates to help you discover the most affordable options for your specific needs.

2. Evaluating Tesla Insurance Availability and Expansion

Tesla Insurance is a relatively new entrant to the insurance market, officially announced by Elon Musk in 2019. As of February 2025, its availability is limited to just 12 states. Here’s the breakdown:

- Arizona

- California

- Colorado

- Illinois

- Maryland

- Nevada

- Ohio

- Oregon

- Texas

- Utah

- Virginia

- Washington

It’s important to note that while Tesla offers car insurance in California, the rates aren’t based on driving performance as tracked by their Safety Score Beta program.

CARS.EDU.VN stays up-to-date on the latest expansions, so you can check our site for new state inclusions and policy updates.

3. Comparing the Cheapest Insurance Options for Your Tesla

Tesla Insurance isn’t the only avenue for securing coverage for your electric vehicle. Traditional insurance providers may offer more competitive rates based on factors such as age, gender, credit score, and driving history. Let’s take a look at some of the cheapest options for various Tesla models:

3.1. Tesla Model 3: Affordable Coverage Options

For a 2021 Tesla Model 3, third-party insurance averages around $3,664 annually, or $305 per month. However, Travelers often presents the cheapest full-coverage policy at about $2,252 per year.

| Insurance Company | Monthly Estimate | Annual Estimate |

|---|---|---|

| Travelers | $188 | $2,252 |

| Auto-Owners Insurance | $199 | $2,393 |

| USAA* | $205 | $2,456 |

| Nationwide | $206 | $2,472 |

| Erie Insurance | $259 | $3,111 |

| State Farm | $264 | $3,165 |

| Geico | $285 | $3,419 |

*USAA is exclusively available to military members and their immediate family.

3.2. Tesla Model X: Balancing Cost and Luxury

Insuring a Tesla Model X tends to be more expensive due to higher maintenance costs. The cheapest rates start around $2,925 per year with Auto-Owners, but can climb to $3,988 annually with Progressive.

| Insurance Company | Monthly Estimate | Annual Estimate |

|---|---|---|

| Auto-Owners Insurance | $244 | $2,925 |

| USAA* | $256 | $3,073 |

| Travelers | $271 | $3,252 |

| State Farm | $297 | $3,567 |

| Erie Insurance | $329 | $3,949 |

| Nationwide | $332 | $3,988 |

| Progressive | $332 | $3,988 |

*USAA is exclusively available to military members and their immediate family.

3.3. Tesla Model Y: Finding Economical Coverage

For the 2021 Model Y, Auto-Owners typically provides the most affordable average rate, around $2,043 per year.

| Insurance Company | Monthly Estimate | Annual Estimate |

|---|---|---|

| Auto-Owners Insurance | $170 | $2,043 |

| USAA* | $182 | $2,187 |

| Nationwide | $185 | $2,217 |

| Country Financial | $188 | $2,252 |

| Erie Insurance | $235 | $2,814 |

| State Farm | $252 | $3,029 |

| Geico | $257 | $3,089 |

3.4. Tesla Model S: Premium Protection at Competitive Prices

Travelers offers the lowest rate for Model S insurance, averaging around $3,181 annually, or $265 per month.

| Insurance Company | Monthly Estimate | Annual Estimate |

|---|---|---|

| Travelers | $265 | $3,181 |

| USAA* | $317 | $3,798 |

| State Farm | $301 | $3,617 |

| Progressive | $377 | $4,518 |

| Farmers | $464 | $5,562 |

| Geico | $473 | $5,674 |

| Allstate | $641 | $7,695 |

*USAA is exclusively available to military members and their immediate family.

4. Tesla Insurance Costs: A State-by-State Comparison

Tesla insurance costs vary significantly by state due to factors like state laws, claim rates, and the likelihood of severe weather events. Generally, states like Ohio, Vermont, and Maine have the lowest Tesla car insurance costs, while Michigan, Louisiana, Massachusetts, and New York tend to be the most expensive.

Below are average full-coverage insurance estimates for Tesla Models 3, S, X, and Y across different states, based on a standardized profile of a 35-year-old driver with a clean driving record and good credit history.

| State | Model 3 | Model S | Model X | Model Y |

|---|---|---|---|---|

| Alabama | $3,002 | $3,967 | $3,635 | $2,886 |

| Alaska | $3,563 | $5,078 | $4,378 | $3,077 |

| Arizona | $4,438 | $5,730 | $5,222 | $4,297 |

| Arkansas | $3,401 | $4,475 | $4,213 | $3,204 |

| California | $3,813 | $5,457 | $5,223 | $3,862 |

| Colorado | $3,620 | $4,930 | $4,366 | $3,345 |

| Connecticut | $5,155 | $6,582 | $6,361 | $4,458 |

| Delaware | $5,051 | $6,251 | $6,134 | $4,283 |

| District of Columbia | $3,679 | $5,095 | $5,165 | $3,600 |

| Florida | $4,737 | $5,688 | $5,773 | $4,906 |

| Georgia | $3,400 | $4,492 | $4,025 | $3,349 |

| Hawaii | $2,188 | $2,578 | $2,405 | $1,862 |

| Idaho | $2,233 | $3,007 | $2,737 | $1,946 |

| Illinois | $3,987 | $5,405 | $5,079 | $3,884 |

| Indiana | $2,695 | $3,572 | $3,274 | $2,493 |

| Iowa | $2,799 | $3,893 | $3,890 | $2,659 |

| Kansas | $3,863 | $4,686 | $4,654 | $3,536 |

| Kentucky | $3,694 | $4,843 | $4,688 | $3,655 |

| Louisiana | $6,674 | $7,484 | $7,447 | $6,105 |

| Maine | $1,955 | $2,979 | $2,573 | $1,860 |

| Maryland | $3,703 | $4,826 | $4,841 | $3,566 |

| Massachusetts | $3,890 | $5,335 | $5,254 | $3,661 |

| Michigan | $6,683 | $8,451 | $8,285 | $5,718 |

| Minnesota | $3,160 | $4,590 | $4,234 | $2,988 |

| Mississippi | $3,297 | $4,473 | $4,263 | $3,245 |

| Missouri | $3,345 | $4,848 | $4,508 | $3,421 |

| Montana | $4,046 | $4,826 | $4,445 | $3,606 |

| Nebraska | $2,787 | $4,104 | $3,806 | $2,622 |

| Nevada | $5,415 | $6,557 | $6,196 | $5,252 |

| New Hampshire | $2,430 | $3,427 | $3,335 | $2,236 |

| New Jersey | $4,453 | $5,487 | $5,012 | $3,464 |

| New Mexico | $3,593 | $4,901 | $4,277 | $3,258 |

| New York | $7,140 | $10,027 | $8,926 | $6,528 |

| North Carolina | $2,731 | $3,244 | $3,262 | $2,480 |

| North Dakota | $2,891 | $4,050 | $3,557 | $2,657 |

| Ohio | $2,145 | $2,939 | $2,978 | $2,150 |

| Oklahoma | $3,633 | $5,310 | $4,575 | $3,550 |

| Oregon | $3,073 | $4,172 | $3,490 | $2,903 |

| Pennsylvania | $5,574 | $6,404 | $6,771 | $5,326 |

| Rhode Island | $4,144 | $5,721 | $5,754 | $3,954 |

| South Carolina | $2,937 | $3,744 | $3,593 | $2,835 |

| South Dakota | $3,366 | $4,639 | $4,403 | $3,077 |

| Tennessee | $3,642 | $5,171 | $4,929 | $3,420 |

| Texas | $3,966 | $4,976 | $4,677 | $3,906 |

| Utah | $3,643 | $4,259 | $3,767 | $3,255 |

| Vermont | $1,791 | $2,747 | $2,411 | $1,684 |

| Virginia | $2,903 | $3,658 | $3,060 | $2,687 |

| Washington | $2,839 | $3,832 | $3,544 | $2,840 |

| West Virginia | $3,222 | $4,774 | $3,923 | $2,985 |

| Wisconsin | $3,041 | $3,989 | $3,867 | $2,869 |

| Wyoming | $2,944 | $4,130 | $4,280 | $2,828 |

Keep in mind that these are just averages, and your actual rate might vary. For more tailored information, CARS.EDU.VN can help you compare quotes from top providers in your state.

5. Examining Tesla Insurance Reviews and Ratings

Tesla Insurance received a 3.8 out of 5 stars from the MarketWatch Guides team, citing limited availability, subpar customer experience ratings, and reputational concerns. This indicates that while the concept is intriguing, the execution has room for improvement.

5.1. Weighing the Pros and Cons of Tesla Insurance

Here’s a quick breakdown of the advantages and disadvantages:

Pros:

- Telematics-based program rewards safe driving habits.

- Potentially cheaper for some Tesla owners.

- Seamless integration with the Tesla app.

Cons:

- Restricted availability (only 12 states).

- Can be expensive for non-Tesla vehicles.

- Reports of unsatisfactory customer service.

5.2. Diving Into Customer Feedback

The Better Business Bureau (BBB) doesn’t currently rate or accredit Tesla, and customer reviews on the BBB site give Tesla a low rating of 1 out of 5 stars, along with a high volume of complaints, even for a company of its size.

5.3. Analyzing Tesla App Reviews

Tesla app reviews often highlight patterns related to customer service. Positive reviews tend to focus on the app’s user-friendliness and the company’s innovative technology, while negative feedback centers on frustrations with customer service representatives when filing insurance claims.

6. Understanding Tesla Car Insurance Coverage

Tesla Insurance offers both standard and additional coverage options, allowing policyholders to customize their protection.

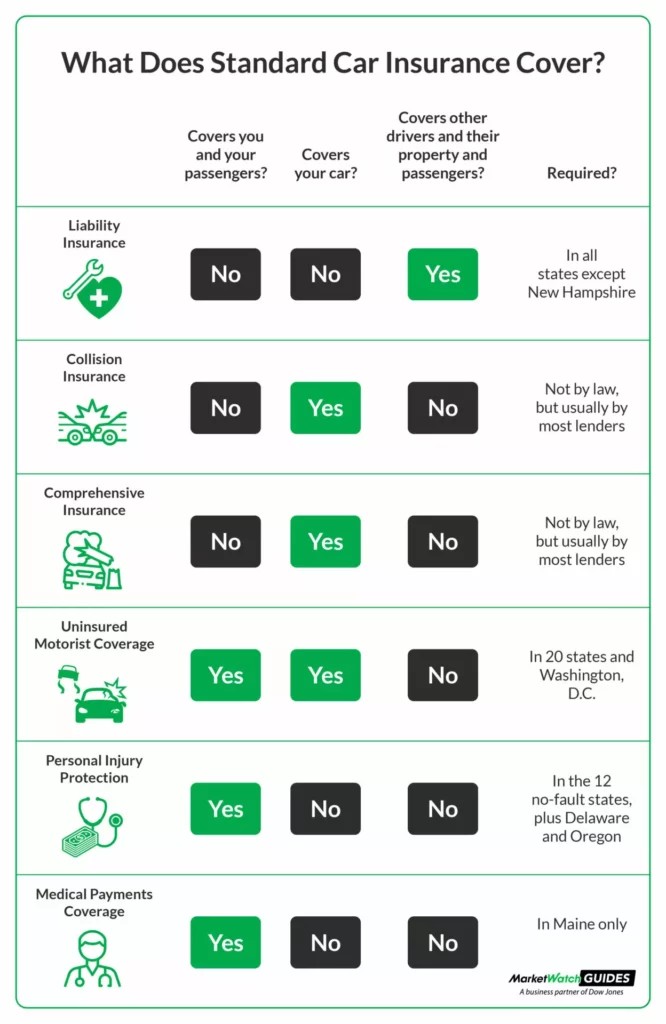

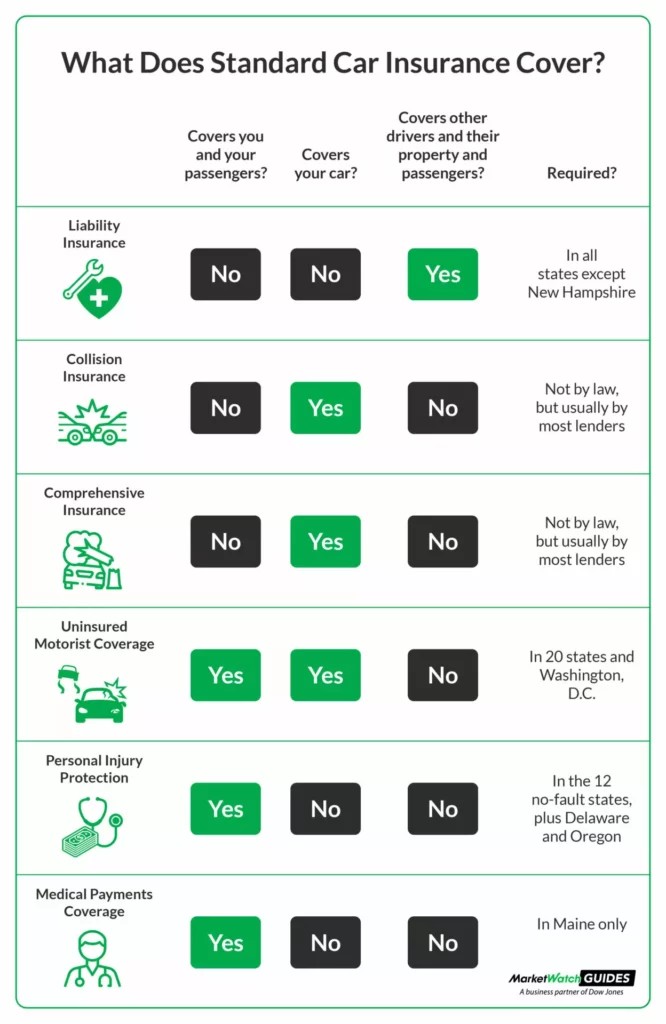

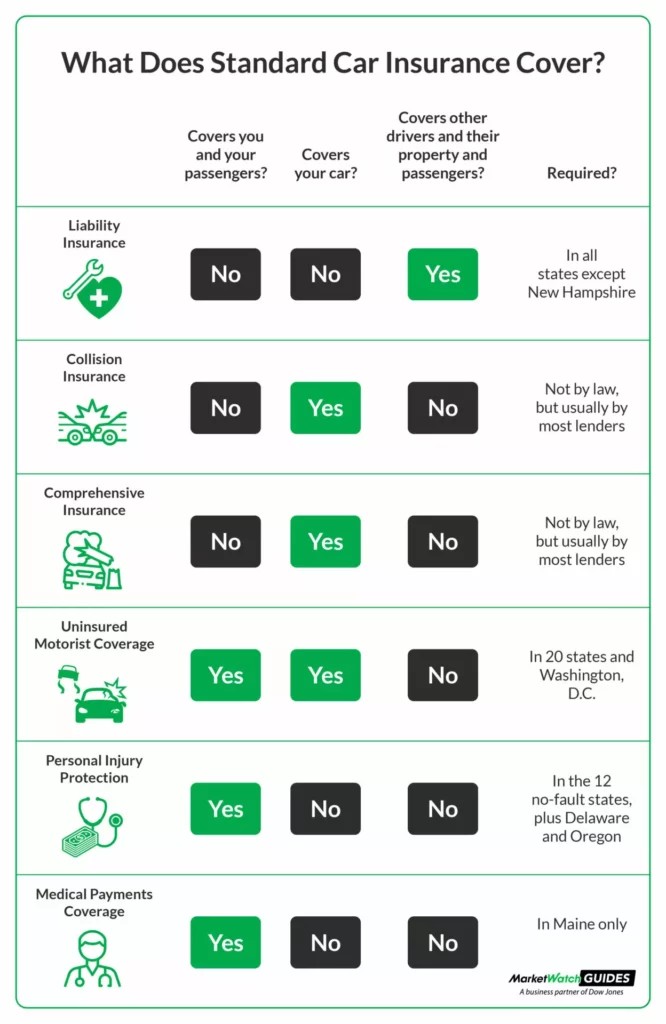

6.1. Essential Standard Coverage Types

Tesla Insurance includes the typical coverage options offered by most car insurers:

- Liability Coverage: Covers damages and injuries to others if you’re at fault in an accident.

- Collision Coverage: Pays for damage to your Tesla from collisions, regardless of fault.

- Comprehensive Coverage: Covers damages to your Tesla from non-collision events such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver with little or no insurance.

- Medical Payments Coverage (MedPay): Covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): Similar to MedPay, but may also cover lost wages and other expenses.

6.2. Exploring Additional Coverage Options

Tesla Insurance provides a few supplemental coverages (availability varies by state):

- Rental Car Reimbursement: Helps pay for a rental car while your Tesla is being repaired.

- Roadside Assistance: Covers services like towing, jump-starts, and tire changes.

- Gap Insurance: Covers the difference between what you owe on your car loan and the car’s actual cash value if it’s totaled.

6.3. Potential Tesla Insurance Discounts

Tesla Insurance may offer discounts based on several factors, including:

- Accident-Free History: Rewards drivers with a clean driving record.

- Anti-Theft Device: Discounts for vehicles equipped with anti-theft systems.

- Good Driver Discount: Available to drivers with no recent traffic violations.

- Defensive Driving Course: Savings for completing an approved defensive driving course.

- Multi-Car Discount: For insuring multiple vehicles on the same policy.

7. Decoding Tesla’s App-Based Rate Calculation

In most states where it operates, Tesla calculates insurance rates by monitoring driving behaviors. Using the mobile app and integrated technology, Tesla assesses factors like hard braking, cornering, speed, and nighttime driving to assign a Safety Score from 0 to 100. A higher score translates to safer driving and potentially lower rates.

7.1. How the Safety Score Influences Premiums

Your Safety Score impacts your monthly insurance premium. Tesla emphasizes that it does not consider factors like age, gender, credit score, or marital status, which sets it apart from traditional insurers.

7.2. Factors Affecting Tesla Insurance Rates

Tesla sets rates based on these key elements:

- Tesla Model: More affordable models like the Model Y generally have lower insurance costs than premium models like the Model X.

- Location: Rates differ by state and can vary within a state depending on local risk factors.

- Miles Driven: Higher mileage typically results in increased insurance rates.

- Deductible: Choosing a lower deductible means higher monthly premiums, but less out-of-pocket expense for repairs.

- Coverage Levels: Comprehensive coverage and higher policy limits lead to higher rates, but offer greater protection.

- Safety Score: The Safety Score is determined by:

- Forward collision warnings per 1,000 miles.

- Autopilot disengagements.

- Hard braking incidents.

- Aggressive turning.

- Unsafe following.

Monthly premiums can fluctuate, particularly with Tesla Insurance, due to the Safety Score’s dynamic nature.

8. Tesla Car Insurance: Your Questions Answered

Here are some frequently asked questions about insuring a Tesla:

Q1: Why is Tesla insurance generally more expensive?

A: Tesla models are often more costly to repair or replace, contributing to higher insurance premiums.

Q2: Is Tesla Insurance a good choice?

A: Tesla Insurance can be a viable option, especially for Tesla enthusiasts who appreciate the brand’s technology and integrated app experience.

Q3: Is it cheaper to insure a gas car versus an electric car?

A: Currently, insuring gas-powered vehicles tends to be less expensive than insuring electric cars due to the higher cost and relative scarcity of EV components like batteries and wall chargers.

Q4: Can I insure a non-Tesla vehicle with Tesla Insurance?

A: Yes, Tesla Insurance allows you to insure non-Tesla vehicles by adding them to your existing policy.

9. Navigating Tesla Car Ownership with CARS.EDU.VN

At CARS.EDU.VN, we understand the unique challenges and opportunities that come with Tesla ownership. From understanding insurance costs to finding reliable maintenance services, we’re here to support you every step of the way.

Our comprehensive resources and expert insights empower you to make informed decisions and maximize your Tesla ownership experience. Whether you’re seeking the most affordable insurance options, expert advice on maintenance, or the latest news in the EV world, CARS.EDU.VN has you covered.

10. Expert Insights and Methodological Approach

Our team is committed to delivering objective and accurate information. We use a comprehensive rating system to evaluate car insurance companies, analyzing a wide range of factors to create our rankings.

10.1. Ranking Factors

Our ratings take into account the following factors:

- Coverage (30%): Companies offering a diverse range of coverage options are more likely to meet consumer needs.

- Cost and Discounts (25%): We analyze auto insurance rate estimates and available discount opportunities.

- Industry Standing (20%): Our research team considers market share, industry expert ratings, and years in business.

- Customer Experience (15%): We assess complaint volumes reported by the National Association of Insurance Commissioners (NAIC) and customer satisfaction ratings from J.D. Power.

- Availability (10%): Companies with broader state availability and fewer eligibility requirements score higher.

10.2. Credential and Expertise

Our team has invested significant time and resources into providing you with the most reliable information:

- 800+ hours of research

- 130+ companies reviewed

- 8,500+ consumers surveyed

Data accurate at time of publication.

At CARS.EDU.VN, we’re dedicated to helping you navigate the world of Tesla ownership with confidence.

Ready to explore more and find the perfect insurance for your Tesla? Visit CARS.EDU.VN today for personalized quotes, expert advice, and all the resources you need to make informed decisions. Contact us at 456 Auto Drive, Anytown, CA 90210, United States. Whatsapp: +1 555-123-4567. We’re here to help you drive smarter and safer.

FAQ: Your Burning Questions About Tesla Car Insurance Answered

Q1: What makes Tesla insurance different from traditional car insurance?

Tesla insurance often uses real-time driving data to personalize rates, potentially rewarding safer drivers. This contrasts with traditional insurance, which relies more on historical data like age, credit score, and driving record.

Q2: How does Tesla’s Safety Score affect my insurance premium?

A high Safety Score, based on your driving behavior, can lead to lower premiums, while a low score may result in higher costs.

Q3: Can I get Tesla insurance if I don’t own a Tesla?

Yes, Tesla Insurance allows you to add non-Tesla vehicles to your policy in some states.

Q4: What are the key factors that determine the cost of Tesla insurance?

Factors include the Tesla model, your location, miles driven, chosen deductible, coverage levels, and Safety Score.

Q5: Is Tesla insurance available in all states?

No, Tesla insurance is currently available in a limited number of states, as listed above. Check CARS.EDU.VN for updates on availability.

Q6: How can I lower my Tesla insurance rates?

Improve your Safety Score by practicing safe driving habits, choose a higher deductible, and explore available discounts.

Q7: What should I do if I’m not happy with Tesla insurance?

You can compare rates from other insurance providers to find a better deal. CARS.EDU.VN offers a convenient tool for comparing quotes.

Q8: Does Tesla insurance cover Autopilot-related accidents?

Coverage for Autopilot-related accidents depends on the specific circumstances and policy terms. It’s crucial to review your policy details carefully.

Q9: How does Tesla insurance handle claims?

Tesla insurance aims for a seamless claims process through its app, but customer reviews suggest experiences can vary.

Q10: Where can I find the most up-to-date information on Tesla insurance?

Stay informed by visiting the official Tesla Insurance website and consulting reliable resources like cars.edu.vn for the latest updates and expert insights.