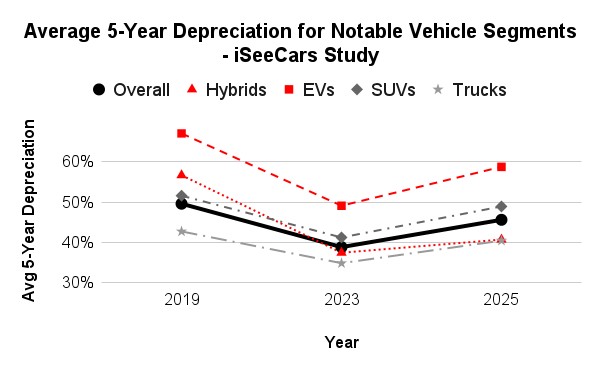

Car depreciation is a significant factor for vehicle owners, representing a major cost of ownership that can vary dramatically depending on the type of vehicle. Recent data reveals that while used car prices have generally decreased from pandemic peaks, depreciation rates are rising across all vehicle segments. This means new cars are losing value faster than before as both new and used car inventories normalize after COVID-related production disruptions.

However, the rate at which vehicles depreciate differs significantly across segments. Electric vehicles (EVs) are currently depreciating the most, losing a staggering 58.8% of their value within the first five years. In contrast, trucks and hybrid vehicles demonstrate the best value retention, depreciating by approximately 40.4% and 40.7%, respectively. The average depreciation across all vehicle types is 45.6%, a notable increase from the 38.8% average in 2023 but still less than the 49.6% seen in 2019.

These insights come from an iSeeCars study analyzing over 800,000 five-year-old used cars sold between March 2024 and February 2025. The study highlights the critical importance of considering depreciation when purchasing a new vehicle.

| 5-Year Vehicle Depreciation by Segment – iSeeCars Study (2025) |

|---|

| Vehicle Segment |

| Overall Average |

| Hybrids |

| Electric Vehicles (EVs) |

| SUVs |

| Trucks |

Chart showing average 5-year depreciation for vehicle segments including overall, hybrids, EVs, SUVs, and trucks from iSeeCars study.

“Depreciation is a major factor in the cost of owning a new car, and the wide range we see across different types of vehicles should be a key consideration for buyers,” notes Karl Brauer, Executive Analyst at iSeeCars. “Choosing a hybrid over an electric vehicle, for example, could save you tens of thousands of dollars in lost value over five years.”

Top Cars That Hold Their Value

Certain models consistently defy the average depreciation trends. The Porsche 911 and Porsche 718 Cayman lead the pack as the vehicles that depreciate the least over five years. Following closely are the Toyota Tacoma, Chevrolet Corvette, and Honda Civic. A closer look at the top 25 vehicles reveals a strong presence of sports and performance cars, alongside compact SUVs, with a few trucks and sedans also making the list of best value retention vehicles.

| Top 25 Cars with the Lowest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

| 9 |

| 10 |

| 11 |

| 12 |

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

| 22 |

| 23 |

| 24 |

| 25 |

| Overall Average |

“The Porsche 911 and 718 Cayman consistently demonstrate exceptional value retention, a trend we’ve observed even before the pandemic,” Brauer points out. “Interestingly, sports cars and small SUVs dominate this year’s list of vehicles holding value, with small SUVs reflecting their popularity as top-selling models for many automakers.”

Cars That Depreciate the Most

Conversely, premium and luxury models tend to depreciate more rapidly than mainstream vehicles. This trend is evident in the list of cars with the highest depreciation rates, which includes a significant number of electric vehicles. The Jaguar I-PACE tops the list for value loss, followed by other EVs like the Tesla Model S, Nissan LEAF, and Tesla Model X, alongside luxury sedans and SUVs. Notably, electric vehicles and luxury models occupy 23 of the 25 spots for cars with the steepest depreciation.

| Top 25 Cars with the Highest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

| 9 |

| 10 |

| 11 |

| 12 |

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

| 22 |

| 23 |

| 24 |

| 25 |

| Overall Average |

“For buyers considering luxury vehicles, it’s crucial to understand both the percentage and dollar amount of depreciation,” Brauer advises. “While the allure of a premium brand and features is strong for new car buyers, the used car market doesn’t value these aspects as highly, leading to consistently greater depreciation for luxury models.”

Electric Vehicle Depreciation Trends

Electric vehicles, as a segment, exhibit the highest depreciation rates. Only two EVs, the Tesla Model 3 and Hyundai Kona Electric, manage to stay above the average EV depreciation of 58%. Among EVs, the Jaguar I-PACE experiences the most significant value drop, losing over 72% of its original value in five years.

| EV Depreciation Ranked – iSeeCars Study (2025) |

|---|

| Rank |

| Overall Average |

| 1 |

| 2 |

| EV Average |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

| 9 |

“Even the Tesla Model 3, which has the lowest depreciation among electric vehicles, still depreciates at a rate over 10% higher than the overall industry average. Depreciation only worsens for other EVs,” Brauer explains.

Hybrid Vehicles: Strong Value Retention

Hybrid vehicles stand out for their strong value retention, depreciating just 40.7% on average after five years. Toyota dominates the hybrid segment in terms of value retention, with seven models outperforming the segment average.

| Hybrid Vehicle Depreciation Ranked – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| Hybrid Average |

| 8 |

| 9 |

| Overall Average |

| 10 |

| 11 |

| 12 |

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

“Hybrids are proving to be excellent at holding their value, contrasting sharply with electric vehicles,” says Brauer. “They offer fuel efficiency without the range concerns of EVs, and their popularity is growing as consumers recognize their value retention benefits.”

Trucks: Traditionally Strong Resale Value

Trucks traditionally hold their value better than most vehicle types. The Toyota Tacoma and Toyota Tundra top the truck segment for value retention, followed by the Ford Ranger, Jeep Gladiator, GMC Canyon, and Nissan Frontier, all of which depreciate less than the average for trucks (40.4%).

| Truck Depreciation Ranked – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| Truck Average |

| 7 |

| 8 |

| 9 |

| 10 |

| 11 |

| 12 |

| Overall Average |

| 13 |

| 14 |

| 15 |

“Midsize trucks often outperform full-size models in value retention, suggesting buyers appreciate the blend of capability, economy, and size that midsize trucks offer,” Brauer observes.

Top Small SUVs for Value Retention

Small SUVs are incredibly popular in the new car market, and this demand carries over into the used market, helping them maintain strong residual values. Models like the Toyota RAV4, Honda CR-V, and Subaru Forester are among the leaders in value retention within this segment.

| Top 5 Small SUVs with the Lowest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Small SUV Average |

“Compact SUVs are a sweet spot for many buyers, combining utility, fuel efficiency, and reasonable pricing, which makes them highly sought after in both the new and used car markets,” says Brauer.

Small SUVs with Highest Depreciation

At the other end of the spectrum, some small SUVs depreciate significantly faster. Electric models dominate the list of small SUVs with the highest depreciation, including the Jaguar I-PACE and Tesla Model Y. All of the SUVs on this list lose more than 59% of their value within five years.

| Top 5 Small SUVs with the Highest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Small SUV Average |

“While the average small SUV loses less than $15,000 in value over five years, these models lose upwards of $23,000, with the Jaguar I-PACE losing more than twice that amount, approaching $52,000,” Brauer points out.

Top Midsize SUVs for Value Retention

Midsize SUVs are another popular category where certain models excel at holding their value. The Toyota 4Runner leads this segment, depreciating only 31.3% after five years. All top five midsize SUVs for value retention perform significantly better than the segment average of 51.2%.

| Top 5 Midsize SUVs with the Lowest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Midsize SUV Average |

“The Jeep Wrangler has long been recognized for its excellent value retention,” notes Brauer. “However, this year, the Toyota 4Runner has surpassed the Wrangler to claim the top spot.”

Midsize SUVs with Highest Depreciation

Luxury models again dominate the list of midsize SUVs with the highest depreciation. All SUVs in this category depreciate by more than 60%, significantly above the segment average.

| Top 5 Midsize SUVs with the Highest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Midsize SUV Average |

“For those interested in midsize luxury SUVs, it’s important to remember that buying new can mean losing between $30,000 and $65,000 in value within five years,” cautions Brauer.

Top Large SUVs for Value Retention

Large SUVs typically come with a high initial purchase price and significant depreciation. However, some models like the Mercedes-Benz G-Class, GMC Yukon, and Chevrolet Tahoe manage to mitigate these losses relatively well compared to the segment average.

| Top 5 Large SUVs with the Lowest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Large SUV Average |

“While the Mercedes-Benz G-Class leads in value retention among large SUVs, it still depreciates by over $57,000 after five years,” notes Brauer. “The Chevrolet Tahoe, while perhaps not as prestigious, loses about half as much value.”

Large SUVs with Highest Depreciation

Luxury models also dominate the list of large SUVs with the highest depreciation rates. The Nissan Armada also appears on this list, likely due to its older design prior to its 2025 refresh.

| Top 5 Large SUVs with the Highest 5-Year Depreciation – iSeeCars Study (2025) |

|---|

| Rank |

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| Large SUV Average |

“For buyers who find large luxury SUVs unaffordable when new, the used market offers a chance to own models like the Infiniti QX60, Land Rover Range Rover, and Cadillac Escalade at significantly reduced prices due to depreciation,” concludes Brauer.

Strategic Car Buying

Understanding vehicle depreciation is crucial for making informed car buying decisions. This study provides valuable insights for consumers looking to minimize depreciation by choosing vehicles known to hold their value, or for those seeking to capitalize on depreciation by purchasing used models that have already experienced significant value loss.

Methodology

The iSeeCars study analyzed over 800,000 used cars from model year 2019 sold between March 2024 and February 2025. Heavy-duty trucks, vans, models discontinued after 2024, and low-volume models were excluded. Original MSRPs were adjusted for inflation to 2025 values using data from the US Bureau of Labor Statistics. Depreciation was calculated as the difference between the inflation-adjusted MSRP and the average used car asking price.

About iSeeCars.com

iSeeCars.com is a data-driven automotive search and analysis company that empowers consumers with insights and resources to find the best car deals. Their tools include the iSeeCars VIN Check report and Best Cars Rankings. iSeeCars leverages big data analytics, processing over 25 billion data points with proprietary algorithms to objectively analyze, score, and rank millions of new and used vehicles. To date, iSeeCars has saved users over $432 million.