The seemingly simple question, “What Is A Car?” takes on unexpected complexity when regulations enter the picture. A recent example highlights this perfectly: the Tesla Model Y. Initially deemed ineligible, it was later granted a $7,500 electric vehicle tax credit by the US Treasury. This reversal, based on whether the Model Y was classified as a car or a light truck, underscores the nuanced, and sometimes arbitrary, nature of automotive definitions in policy. Tesla, in a swift response, increased its prices, demonstrating how quickly market dynamics can shift with regulatory tweaks.

This Model Y case is just the tip of the iceberg. The Inflation Reduction Act has unleashed a torrent of subsidies, each requiring a cascade of rulings to determine eligibility. The Treasury Department is now tasked with defining everything from “green” hydrogen to “energy communities,” facing intricate questions like whether a power plant component is “primarily” iron or steel. Even the electric vehicle tax credits continue to be a moving target, subject to ongoing changes.

The core issue with the Tesla Model Y – car versus light truck classification – is far from new. It has a long and convoluted history, linking figures as diverse as Ayatollah Khomeini and Elon Musk through vehicles like the Chrysler minivan and the PT Cruiser. This seemingly mundane distinction has been a major driver of industry trends, with significant global repercussions for both the environment and vehicle safety. Exploring this history serves as a crucial reminder: even seemingly straightforward regulatory definitions can have profound and unforeseen consequences.

The Regulatory Line: Car or Truck? It’s Not Always Clear-Cut

The legal differentiation between light-duty trucks and cars dates back to the oil crises of the 1970s, a period heavily influenced by events like the Iranian Revolution. In an effort to curb oil consumption, the United States introduced measures like the Gas Guzzler Tax and Corporate Average Fuel Economy (CAFE) standards. Crucially, the Gas Guzzler Tax, which could impose a hefty excise tax up to $7,700 on fuel-inefficient vehicles, was applied only to cars, explicitly excluding trucks. Similarly, CAFE standards were established separately for cars and trucks, with trucks facing considerably less stringent fuel efficiency targets.

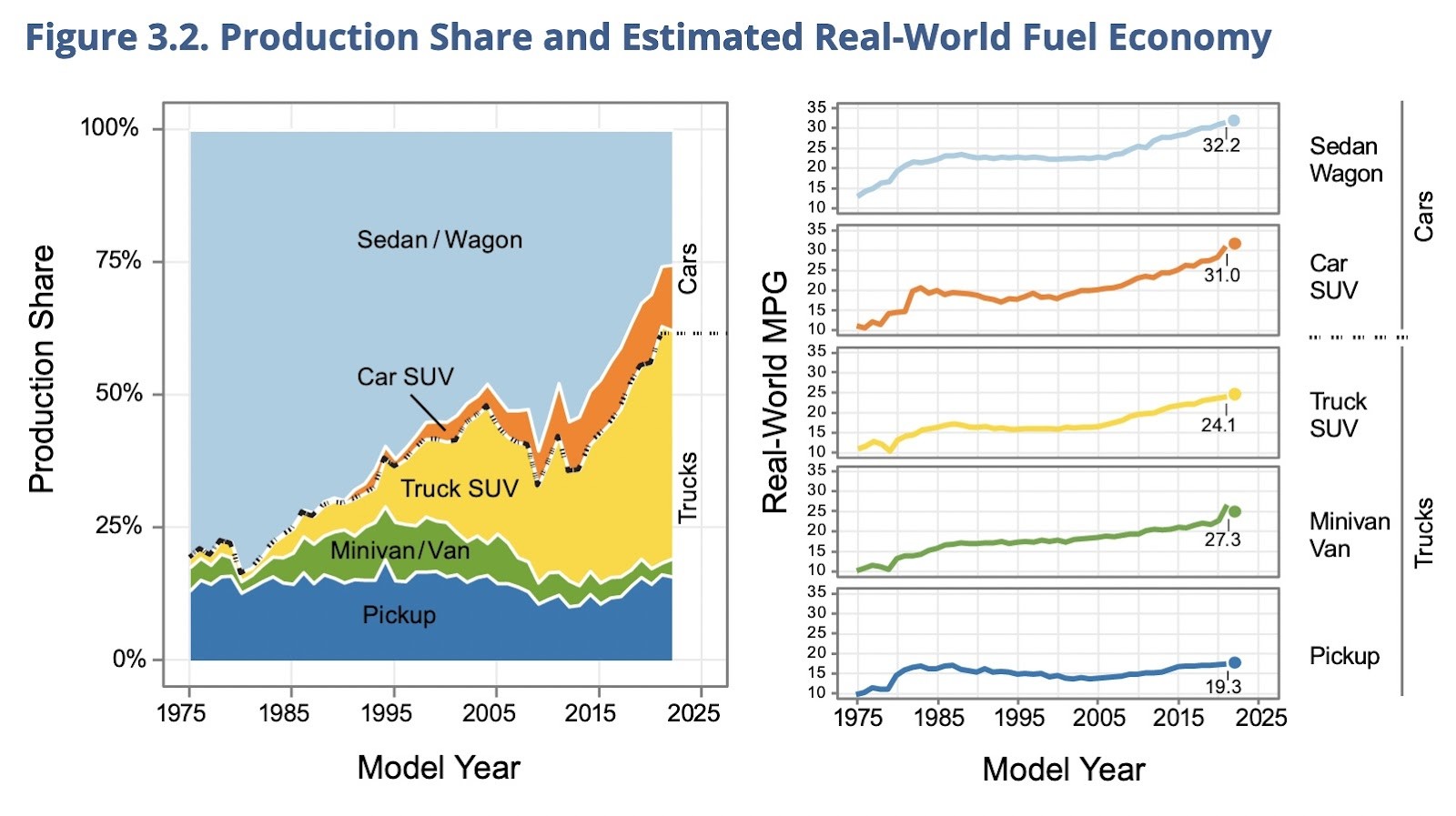

The share of light trucks in the US vehicle market has dramatically increased since the 1970s due to regulatory definitions. Source: US EPA Fuel Economy Trends Report 2022.

At the time these regulations were enacted, trucks constituted a relatively small portion of the personal vehicle market, around 15%, and were almost exclusively pickup trucks. Setting lower fuel economy standards for trucks seemed logical; they were generally larger and designed for hauling cargo. However, this regulatory distinction inadvertently created a powerful incentive for automakers: to design and market vehicles that, while legally classified as trucks, could effectively meet the needs of consumers who traditionally purchased cars rather than pickups.

This regulatory loophole ignited a wave of automotive innovation. The 1980s saw the rise of the minivan, pioneered by Chrysler. Despite serving the same family transportation needs as large sedans and station wagons (categorized as cars), minivans were legally classified as light trucks. As gasoline prices remained low in the 1990s and fuel economy standards became more restrictive, the automotive industry further exploited this classification by reimagining and rebranding SUVs as trucks. These SUVs effectively replaced larger luxury sedans in the market. Pickup trucks also evolved, becoming larger, more luxurious, and capable of comfortably seating five or even six passengers, transforming into family vehicles. More recently, cars have increasingly morphed into crossover vehicles, many of which are legally classified as trucks, even when their design and function closely resemble cars, albeit often with a slightly raised ride height.

The Chrysler PT Cruiser is a prime example of a vehicle classified as a “light truck” despite its car-like appearance and function, highlighting the regulatory complexities.

By 2021, the impact of this regulatory classification was undeniable. Vehicles legally defined as trucks had surged to a staggering 63% of the personal vehicle market in the US. While the 20th century saw America’s love affair with the car, the early 21st century witnessed a shift in affections, with the truck becoming the vehicle of choice for a majority of consumers.

The Real-World Consequences of a Regulatory Definition

This story of the ever-evolving “truck” classification has significant real-world consequences. While it’s difficult to definitively quantify the precise influence of policy incentives, industry experts and economic logic strongly suggest that these regulations played a crucial role in the dramatic rise of the light-duty truck.

This shift from cars to trucks has notable environmental and safety implications. The effectiveness of CAFE standards and related policies has been diminished by this trend. During the 1990s and early 2000s, while fuel economy improved for both cars and trucks individually, overall fleet-wide fuel consumption stagnated. This was because the increasing market share of less fuel-efficient trucks effectively counteracted the fuel economy gains made in both vehicle categories.

Trucks, generally being heavier and often larger than cars, also present safety concerns. Heavier vehicles are inherently more dangerous in collisions. Even at comparable weights, the higher ride height of many trucks increases the risk to pedestrians and cyclists in accidents.

Furthermore, the growing popularity of trucks is becoming a global phenomenon. Having successfully marketed SUVs to American consumers for decades, global automakers are now increasingly promoting similar models in international markets, contributing to a steady rise in SUV market share worldwide.

Global SUV sales have consistently increased, negatively impacting emissions reduction efforts. Source: IEA.

The special regulatory treatment afforded to light trucks exemplifies what economists term attribute-based regulation. This type of regulation is often inefficient because it incentivizes actors to achieve compliance by manipulating product characteristics (like qualifying for the “truck” category) rather than directly addressing the intended environmental target (reducing fuel consumption). A more effective approach might be to eliminate the regulatory distinction between cars and trucks altogether. This could strengthen environmental regulations, remove the incentive for automakers to design vehicles primarily for regulatory compliance rather than efficiency, and ultimately lead to safer vehicles.

Historically, the primary beneficiaries of preferential truck regulations were often perceived to be farmers and small business owners – groups holding significant political sway in the US. While this connection may be less direct today, the constituency for light trucks is now vast and deeply entrenched, suggesting significant resistance to any potential reversal of this fifty-year trend.

Lessons for Today’s Energy Policy Landscape

The history of the light truck serves as a potent reminder that seemingly simple definitions and regulatory choices made today can lead to unexpected and far-reaching consequences tomorrow. These choices create incentives that can drive what we might call “creative compliance,” where actors find ways to maximize benefits within the regulatory framework, even if it deviates from the original policy intent. Recent reports indicate that the EPA is poised to significantly tighten CAFE standards, which could further incentivize automakers to seek innovative, and potentially unintended, compliance strategies.

As Jim pointed out, effectively rewarding “good stuff” in the market necessitates clearly defining what constitutes “good stuff.” This definitional process is often more challenging than it appears and frequently opens the door to unintended outcomes.

The Inflation Reduction Act, with its massive subsidies, necessitates precise definitions across numerous areas. Prevailing wage requirements, crucial for bonus eligibility, apply to “laborers and mechanics” but not necessarily to other worker categories. Developers might seek to optimize their workforce by employing more lower-paid “apprentices” or by reclassifying tasks. Domestic content requirements for batteries hinge on the definition of “critical minerals” (a definition prone to change) and whether these minerals originate from the US or a country with a “free trade agreement” (a term lacking a clear statutory definition). Qualifying an “area” as an “energy community” for bonus credits requires the Treasury to establish consistent methods for defining the proportion of “direct employment” or tax revenue “related to” the extraction, processing, transport, or storage of fossil fuels – all metrics subject to fluctuation and interpretation.

The subsidies within the IRA are substantial, and while we cannot predict whether “creative compliance” with these regulatory definitions will generate distortions as significant as the rise of the light truck, we can be certain that market participants will actively seek every opportunity to maximize their benefits, even if it leads to unforeseen and perhaps undesirable directions.

Keep up with Energy Institute blogs, research, and events on Twitter @energyathaas.

Suggested citation: Sallee, James, “What is a Car?” Energy Institute Blog, UC Berkeley, April 10, 2023, https://energyathaas.wordpress.com/2023/04/10/what-is-a-car/