Navigating the world of car insurance can often feel overwhelming. Policies are filled with jargon, and understanding exactly what you’re covered for can be confusing. Fortunately, there’s a document designed to simplify things: your car insurance declaration page, often called a “dec page.” Think of it as a CliffNotes version of your entire car insurance policy, providing a concise and essential summary of your coverage. Understanding your declaration page is key to quickly grasping your insurance details and ensuring you have the right protection on the road.

Decoding Your Car Insurance Declaration Page: Key Information at a Glance

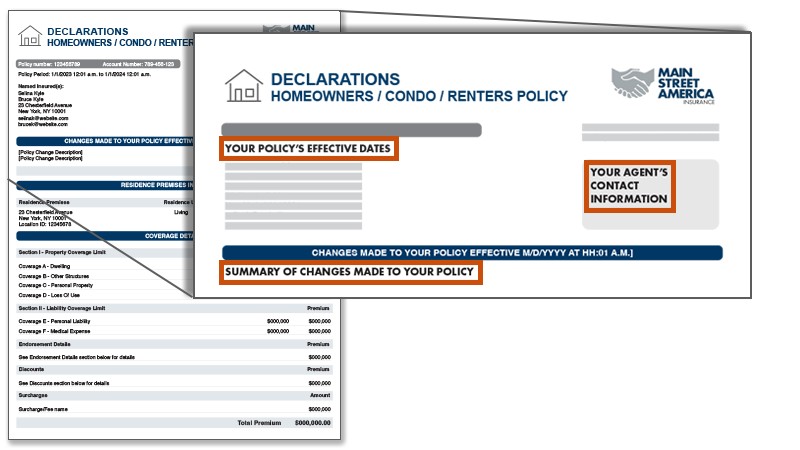

Your car insurance declaration page is typically a one or two-page document that offers a high-level overview of your specific policy. It’s personalized to you and your vehicle and acts as a handy reference point. You’ll receive a declaration page whenever you first purchase a policy, renew it, or make any changes to your coverage. Let’s break down the crucial information you can expect to find on your car insurance dec page:

Essential Policy Details and Identification

The first section of your declaration page is usually focused on identifying the policy itself and those involved. This typically includes:

- Policy Number: Your unique insurance policy identifier.

- Policy Effective and Expiration Dates: The period for which your coverage is active. It’s important to note these dates to ensure continuous coverage and avoid any lapses.

- Insured’s Name and Address: Confirmation that the policy is in your name and for your address.

- Vehicle Information: Details about the car being insured, including the make, model, year, and Vehicle Identification Number (VIN).

- Agent or Insurance Company Contact Information: Details on how to get in touch with your agent or the insurance company directly for any questions or claims.

Breakdown of Your Car Insurance Coverage

A significant portion of your declaration page is dedicated to outlining the types and levels of coverage you’ve selected. This is where you’ll see a summary of your protection, including:

- Coverage Types: This section lists the different types of car insurance coverages you have, such as:

- Liability Coverage: Protects you if you’re at fault in an accident and cause injury or property damage to others.

- Collision Coverage: Covers damage to your vehicle from a collision with another object or vehicle, regardless of fault.

- Comprehensive Coverage: Protects your car from other types of damage, such as theft, vandalism, weather events, and animal damage.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver who either has no insurance or insufficient insurance to cover your damages.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Helps pay for medical expenses for you and your passengers after an accident, regardless of fault.

- Coverage Limits: For each coverage type, the declaration page specifies your coverage limits. These limits are the maximum amount your insurance company will pay out in case of a covered claim. Understanding your limits is critical to ensure you have adequate financial protection.

Premiums, Deductibles, and Other Financial Details

Finally, your declaration page will summarize the financial aspects of your car insurance policy:

- Premium: The total cost of your insurance policy for the coverage period. This is usually shown as an annual or semi-annual amount, and sometimes broken down into payment installments.

- Deductibles: The amount you’ll need to pay out-of-pocket before your insurance coverage kicks in for certain types of claims (like collision or comprehensive). Your declaration page will clearly state your deductibles for each applicable coverage.

- Discounts: Any discounts applied to your policy, such as safe driver discounts, multi-car discounts, or good student discounts, will be listed, showing how they reduce your overall premium.

- Lienholder Information (If Applicable): If you have a loan or lease on your vehicle, your declaration page will include information about the lienholder (the bank or leasing company), as they have a financial interest in the car being insured.

Why is Your Car Insurance Declaration Page So Important?

Your declaration page serves several crucial purposes:

- Proof of Insurance: The declaration page acts as official proof that you have active car insurance coverage. It’s often accepted by DMVs, lenders, and other parties requiring insurance verification.

- Quick Policy Reference: Instead of wading through the entire lengthy policy document, the declaration page provides a fast and easy way to review your key coverage details.

- Verification After Changes or Renewals: When you make changes to your policy or renew it, reviewing your updated declaration page ensures that the changes you requested are accurately reflected and that your coverage is as expected.

Accessing Your Car Insurance Declaration Page

Getting your hands on your declaration page is usually straightforward:

- Check Your Email or Mail: Insurance companies typically send your declaration page when you first purchase a policy, upon renewal, or after any policy changes. Check your email inbox or physical mail for these documents.

- Online Account: Most insurance companies have online portals where you can access and manage your policy documents. Log in to your online account and look for a section labeled “Documents,” “Policy Documents,” or similar, where you should find your declaration page available for download.

- Contact Your Agent or Insurance Company: If you’re having trouble locating your declaration page, don’t hesitate to contact your insurance agent or the customer service department of your insurance company. They can easily provide you with a copy.

In conclusion, your car insurance declaration page is an invaluable tool for understanding your coverage quickly and efficiently. Take the time to review it carefully whenever you receive one – it’s the best way to stay informed about your protection on the road.