Purchasing a car involves more than just the sticker price. Beyond the sales tax, there’s another fee you might encounter: the car excise tax. Understanding What Is Car Excise Tax is crucial for budgeting and avoiding surprises when you’re finalizing your vehicle purchase or registration. This guide will break down the essentials of car excise tax, helping you navigate this aspect of vehicle ownership.

Car excise tax is essentially a tax levied on specific goods or services, and in the automotive world, it’s typically applied to the sale or registration of vehicles. Think of it as a transaction-based tax, often a percentage of the vehicle’s value. Unlike annual property taxes on vehicles, excise tax is usually a one-time fee paid when you initially title a car in a particular jurisdiction. The revenue generated from car excise tax is used by local governments to fund various public services, which can range from road maintenance to public safety initiatives.

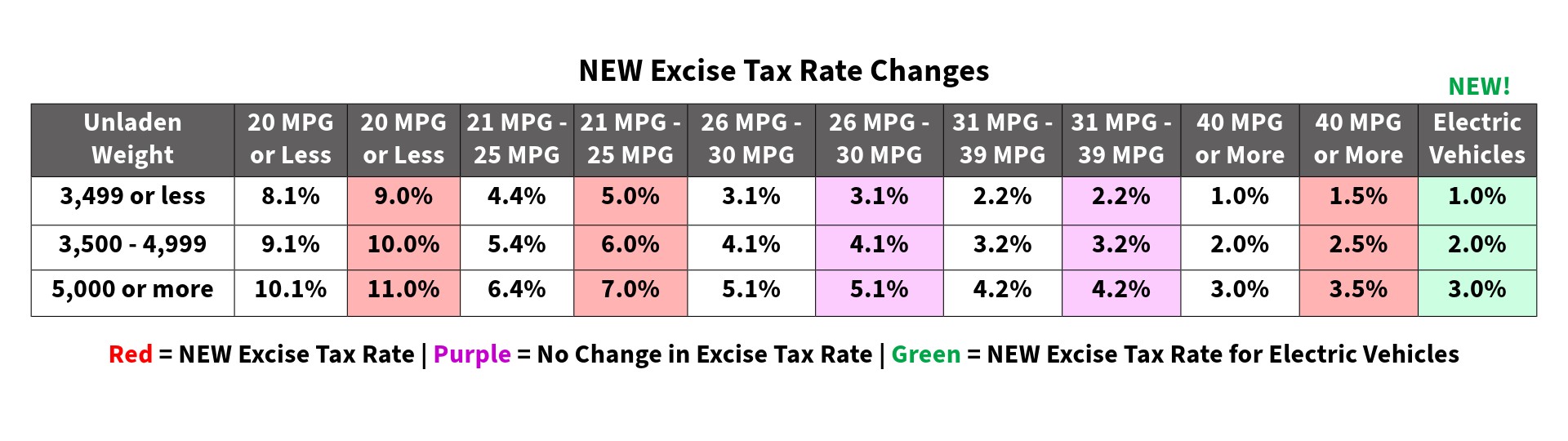

The specifics of car excise tax can vary significantly depending on where you live. For example, in Washington D.C., the excise tax on vehicles is determined by a combination of factors, including the vehicle’s fair market value and its fuel efficiency. This means that the amount you pay isn’t just based on the price of the car but also on its environmental impact and weight. The District of Columbia Department of Motor Vehicles (DC DMV) calculates this tax based on the vehicle’s fair market value, as determined by the National Automobile Dealers Association (NADA) Business Guide.

Excise Tax Fees Effective February 17, 2025

Excise Tax Fees Effective February 17, 2025

The calculation in DC involves a formula that takes the Fair Market Value (FMV) and multiplies it by a Taxable Percentage (%). This percentage is not fixed; it fluctuates based on the vehicle’s unladen weight and its city miles per gallon (MPG) rating. As of February 17, 2025, new excise tax fees have taken effect in DC, altering the taxable percentages. Notably, electric vehicles, which were previously exempt, are now also subject to excise tax. The table above illustrates the current excise tax rates in DC, categorized by vehicle weight and MPG, including a specific rate for electric vehicles.

It’s also important to note that while many jurisdictions have excise taxes, the rules and rates differ. Some areas may have exemptions for certain types of vehicles or for individuals meeting specific criteria. For instance, in DC, individuals who qualify for the District Earned Income Tax Credit (EITC) may have different options for excise tax calculation.

To get an accurate estimate of the car excise tax you might owe in Washington D.C., you can utilize the online excise tax estimator tool provided by the DC DMV. For detailed legal information, you can refer to the DC Official Code § 50-2201.03, which outlines the specifics of motor vehicle excise taxes in the District.

In conclusion, understanding what car excise tax is, how it’s calculated, and what factors influence it is essential for any car buyer or owner. Being informed about these taxes ensures you can accurately budget for your vehicle and understand your financial obligations related to car ownership in your specific location. Always check with your local Department of Motor Vehicles or relevant tax authority for the most accurate and up-to-date information regarding car excise tax in your area.